Investment Products Options Trading

PRODUCTS

Powerful Tools for Advanced Options Trading Worldwide

The IBKR Advantage

- Commissions from

USD 0.15 to 0.65 per US option contract - Trade options globally on 30+ market centers

- Professional trading platforms and advanced options trading tools

- Options trading education available at IBKR Traders' Academy features strategies, tips and tools for success for beginner to advanced investors

Why Trade Options through Interactive Brokers?

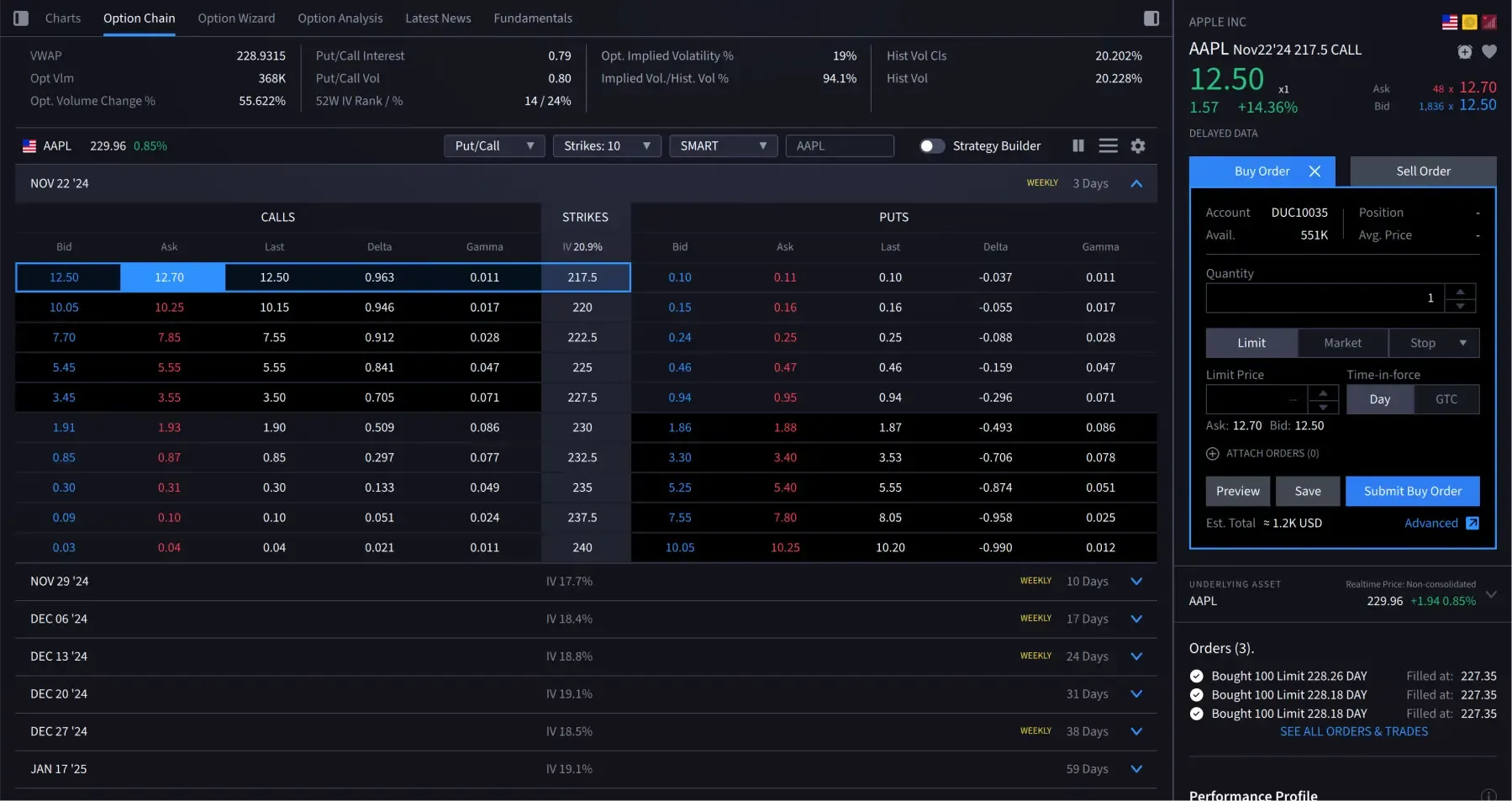

Professional Trading Platforms

Powerful, award-winning trading platforms and tools available on desktop, mobile apps, and web. View market data, positions and trade multiple asset classes and products side-by-side on a single screen.

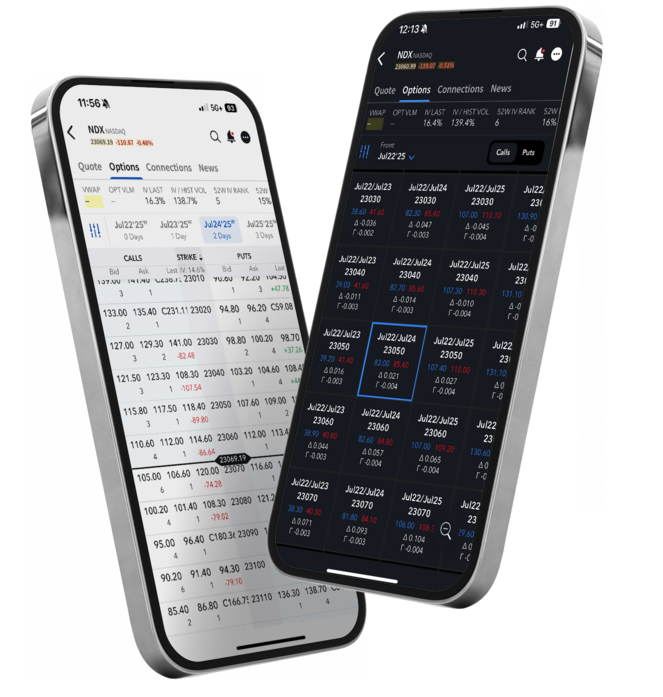

Stay on top of your portfolio and the markets wherever you are. IBKR GlobalTrader, the IBKR Mobile app and the IMPACT app includes everything you need to trade and manage your options on-the-go.

Award Winning Options Broker

Best for professional

options traders

Best for Global Options Traders

Best options trading

platforms and brokers

Best Options Trading

Brokers and Platforms

Best for Advanced

Options Traders

About Options

Financial options are contracts that give the buyer the right, but not the obligation, to buy or sell an asset (like a stock) at a specific price on or before a specific date. They are commonly used for hedging against losses in other investments, speculating on price changes with limited upfront costs, and generating income by selling options to earn premiums.

There are two main types of options:

Call Option

Gives the holder the right to buy an asset at a specific price (called the strike price) before a certain date. This is used when you expect the price of an asset to increase.

Example: Buy a call option on stock XYZ at $50. If XYZ rises to $60, you can still buy it at $50.

Long Call Option Payoff

Underlying Asset Price at Expiration

Strike Price

Breakeven Price

Premium Paid

Profit Area

Loss Area

Put Option

Gives the holder the right to sell an asset at a specific strike price before a certain date. This is used when you expect the price of an asset to decrease.

Example: Buy a put option on stock XYZ at $50. If XYZ drops to $40, you can still sell it at $50.

Long Put Option Payoff

Underlying Asset Price at Expiration

Strike Price

Breakeven Price

Premium Paid

Profit Area

Loss Area

How Do You Purchase Options?

You can purchase options through an online brokerage account that supports option trading, like those available at Interactive Brokers. Many brokers offer tiered options trading permissions based on your trading experience. The most basic tier will typically allow for covered calls and each tier stepping up the options strategies you are allowed to trade.

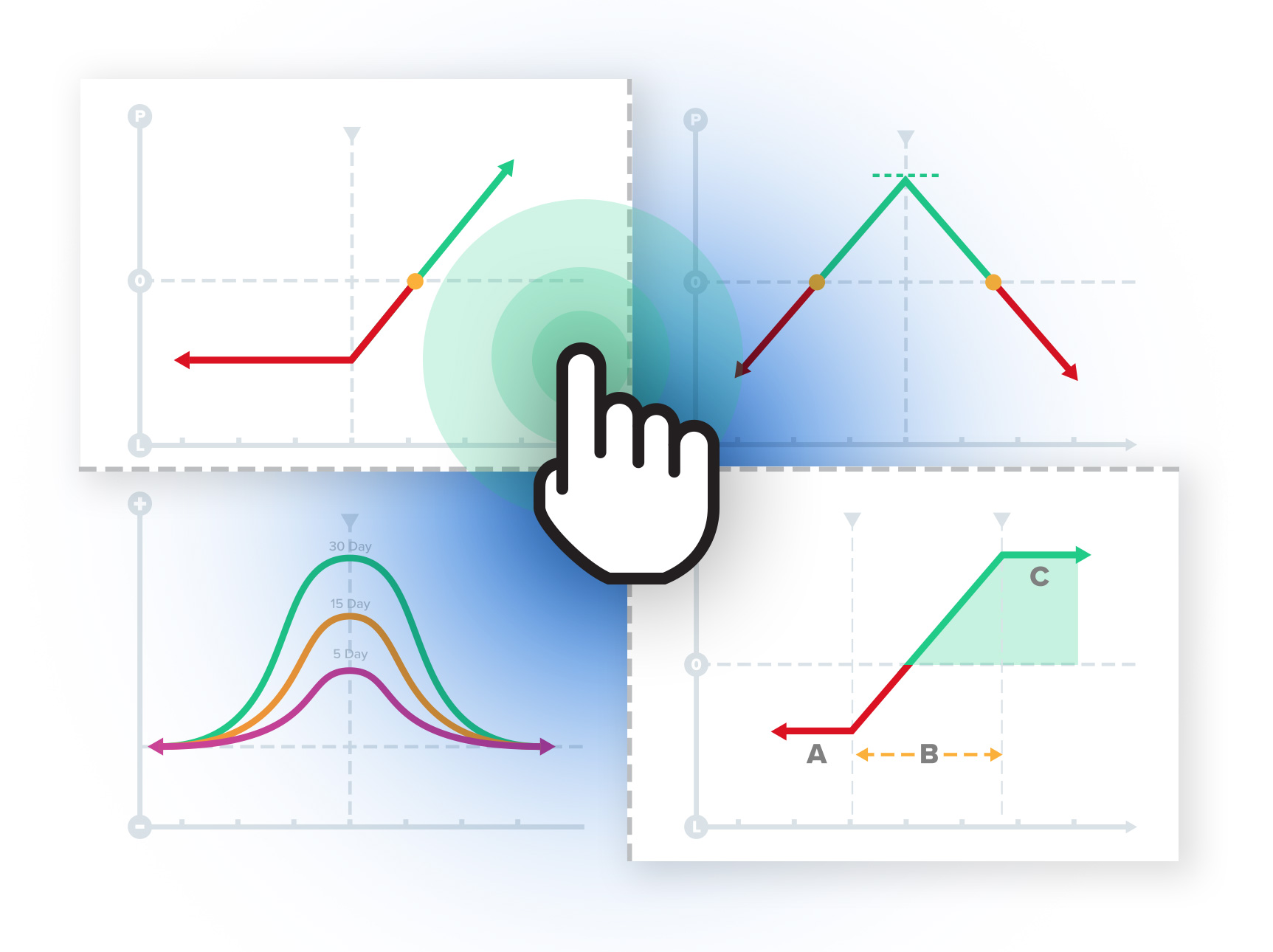

Before purchasing an option, you need to identify the underlying asset for which you will be buying an option, decide whether to purchase a call or put, select a strike price and determine an expiration date. Many brokers will provide you with tools to research options. At Interactive Brokers, clients can use Strategy Builder to create, analyze, and trade multi-leg options strategies such as spreads, condors and straddles, and Probability Lab to visualize market sentiment, define your own probabilities for underlying prices and identify strategies based on your outlook.

You would use your broker’s trading platform to place a trade by entering the ticket symbol of the underlying asset, selecting options chains and type of option you wish to purchase, entering the number of contracts you wish to purchase and submitting the order.

After purchasing the option, you can sell the option at any time before it expires, exercise it if it is “in the money” or allow it to expire worthless.

What Are the Benefits and Risks of Trading Options?

Options trading offers a range of benefits, depending on your investing goals, risk tolerance and market outlook.

- Leverage: You are able to control a large position with a relatively small investment, creating the potential for higher returns based on invested capital.

- Flexible Strategies: Options can be used for speculation, hedging or income generation, allowing you to match your trades with your market views or risk tolerances.

- Risk Management: Many options strategies allow you to define your maximum loss upfront, offering more control over possible downside than outright ownership of the underlying asset.

- Income Generation: You can earn premiums by selling options, generating income in range-bounded markets.

- Potential to Profit in Any Market Direction: You can use options to profit from volatility, direction or the absence of either.

However, options trading comes with unique risks that can be greater than simply buying or selling assets.

- You Risk Losing Your Entire Investment: Options have an expiration date and if the trade doesn’t move in your favor in time, the option may expire worthless.

- There is Potential for Unlimited Losses: Options sellers engaged in selling a naked call or naked put can expose themselves to unlimited loss if the asset’s price skyrockets or collapses.

- Options are Complex: Options trading requires an understanding of multiple variables, and misunderstanding these variables can lead to unexpected losses.

- Time Decay: Each day that passes without favorable movement erodes the option’s value.

- Liquidity Risk: Some options contracts have low trading volume, leading to wider bid-ask spreads that make it harder to enter or exit a strategy at a fair price.

- Assignment Risk: Traders with short options positions can have those options assigned early, requiring the unexpected fulfillment of a contract.

- Volatility Risk: Changes in implied volatility can increase or decrease an option’s value independently of the underlying stock price.

- Tax Complexity: Some options trades, such as spreads and early assignments, can create complex tax situations.

Options involve risk and are not suitable for all investors. An option trader should always know what the maximum potential loss is for any given strategy, understand how volatility and time decay may affect their position, be aware of whether they are subject to assignment and have a clearly defined exit strategy before entering a trade.

For more information read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Interactive Brokers’ Education and Resources for Options

New Interactive Learning

Master options fundamentals with our new Interactive Learning course.

Traders' Academy

Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on options, including an Introduction to Options course and courses on Basic Hedging, Basic Options Strategies, Options Essentials, Neutral Option Market Strategies, Advanced Option Strategies and Trader Workstation (TWS) Option Tools.

IBKR Webinars

Interactive Brokers regularly hosts webinars on options-related topics. If you would like to participate in an upcoming webinar or review a recently completed webinar, visit IBKR Campus.

Traders' Insight

Interactive Brokers Traders’ Insight blog offers daily commentary about options, as well as commentary and analysis from nearly 100 industry pros, including both IBKR's Chief Strategist and Senior Analyst.