Margin Trading

Benefits of a Margin Trading Account

Use the cash or securities in your brokerage account as leverage to increase your buying power.

Get one of the best margin rates in the industry.1

Diversify trading strategies with short selling, options and futures contracts, or currency trading.

Borrow against a margin account at any time and repay the loan on your own schedule.

Understand the Risks of Margin Trading

Margin borrowing is only for experienced investors with high risk tolerance.

You may lose more than your initial investment.

Before trading on margin, understand the following risks

- Trading losses may be greater than the value of the initial investment

- Leveraged investments create a greater potential risk of loss

- Additional costs from margin interest charges

- Potential margin calls or liquidation of securities

How Trading Securities on Margin Works

Rules-based Margin

Margin models determine the type of brokerage accounts you open and the type of financial instruments you may trade.

- In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product. This is the more common type of margin strategy used by securities traders.

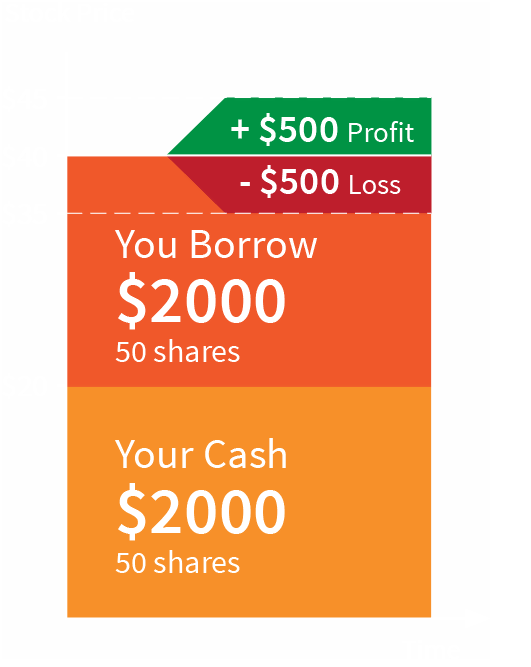

shares @ $40 (50 shares with cash and 50 shares on margin)

Rated Lowest Margin Fees1 by StockBrokers.com

US Margin Loan Rates Comparison2

| USD 25K | USD 300K | USD 1.5M | USD 3.5M | |

|---|---|---|---|---|

| Interactive Brokers | 5.14% | 4.81% | 4.59% | 4.48% |

| E-Trade | 11.95% | 10.45% | N/A | N/A |

| Fidelity* | 11.33% | 10.08% | 7.50% | 7.50% |

| Schwab | 11.33% | 10.08% | N/A | N/A |

| Vanguard | 11.50% | 10.00% | N/A | N/A |

Each firm's information reflects the standard online margin loan rates obtained from their respective websites. Competitor rates and offers subject to change without notice. Services vary by firm.

*Rates applicable only to Fidelity Brokerage Services LLC retail clients.

Margin Education Course on Traders' Academy

Introduction to Margin Trading

This course is designed to help investors understand margin basics, including different types of margin accounts, margining methods, and margin requirements, plus how to monitor margin on both Trader Workstation (TWS) and IBKR Mobile.

Trading on margin is only for sophisticated traders. You may lose more than your initial investment.

- Introduction to Margin

- Monitoring Margin in Trader Workstation (TWS)

- Looking at Margin on IBKR Mobile

Start trading and investing like a professional today!

Open AccountDisclosures

- According to StockBrokers.com Interactive Brokers Review: Read the full article Online Broker Reviews, January 29, 2025. "Interactive Brokers continues to lead with unbeatable margin rates, a significant advantage for active and professional traders."

- Annual Percentage Rate (APR) on USD margin loan balances as of December 15, 2025. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Learn more about margin loan rates.