Investment Products Options Trading

This is Why IBKR Clients Trade 10x More Options*

than at Other Brokers

Low commissions, advanced options tools, and professional trading platforms

Low Options Commissions

Options commissions range from

USD 0.15 to USD 0.65 per US options contract

Advanced Options Trading Tools

Write Options Tool

Rollover Options Tool

Generate extra income with the Write/Rollover Options tool. The Write tool scans your stock positions and calculates the number of covered options to write against your uncovered stock. Use the Rollover tool to roll over options that are about to expire to a similar option with a later expiration date.

OptionTrader

OptionTrader displays market data for the underlying, allows you to create and manage options orders including combination orders, and provides the most complete view of available option chains, all in a single screen.

Options Strategy Builder

Create multi-legged combination orders on the fly, and access predefined combinations (such as straddles, strangles, butterflies and condors). Point to the first desired strike and the tool will adjust to select the remaining legs.

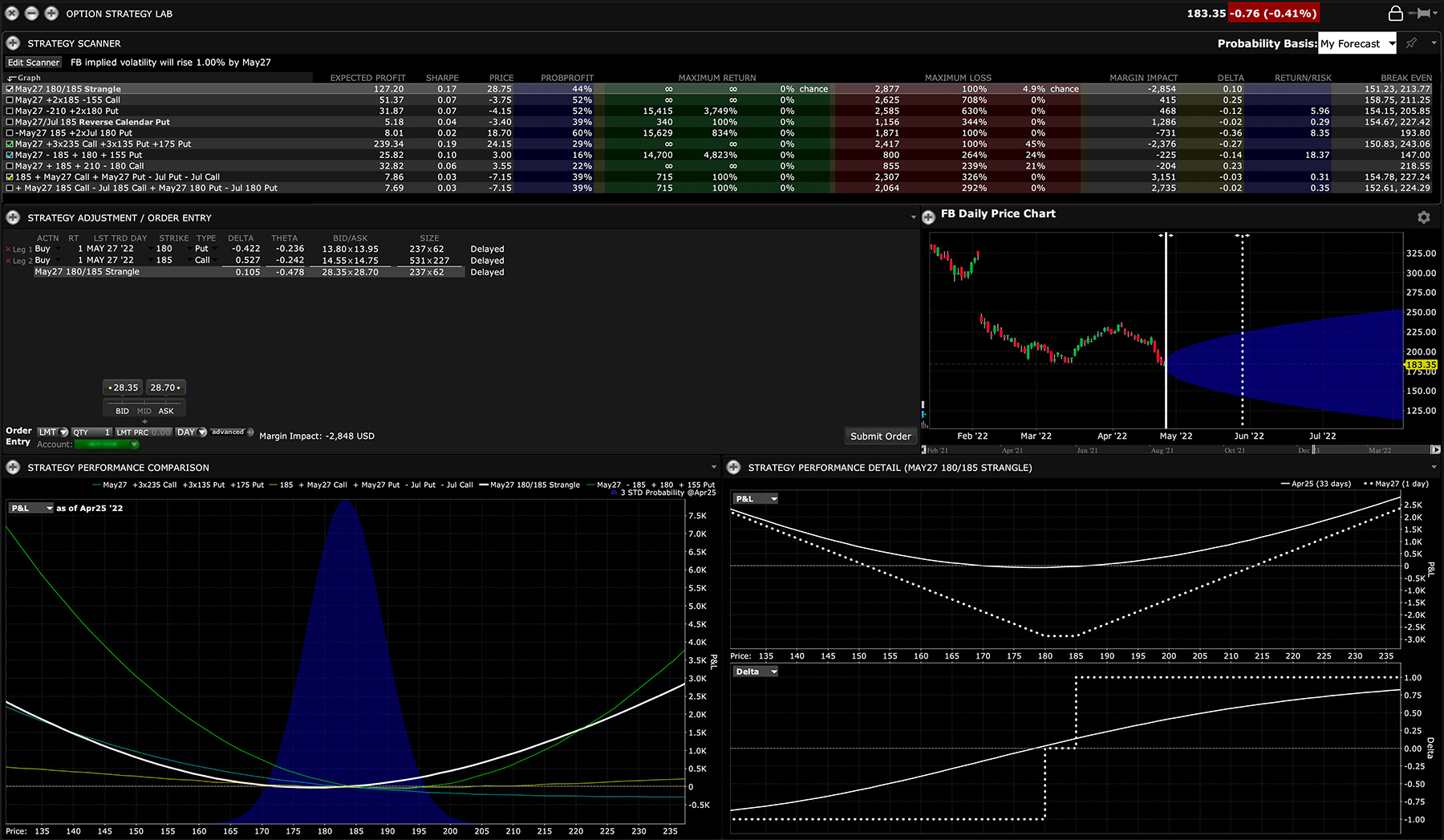

Options Strategy Lab

Generate potentially profitable stock and option combinations, based on your forecast for stock and ETF prices, market volatility and other market variables.

Options Analytics

Manipulate key option pricing criteria – including price, time and implied volatility – and visualize the impact on premiums.

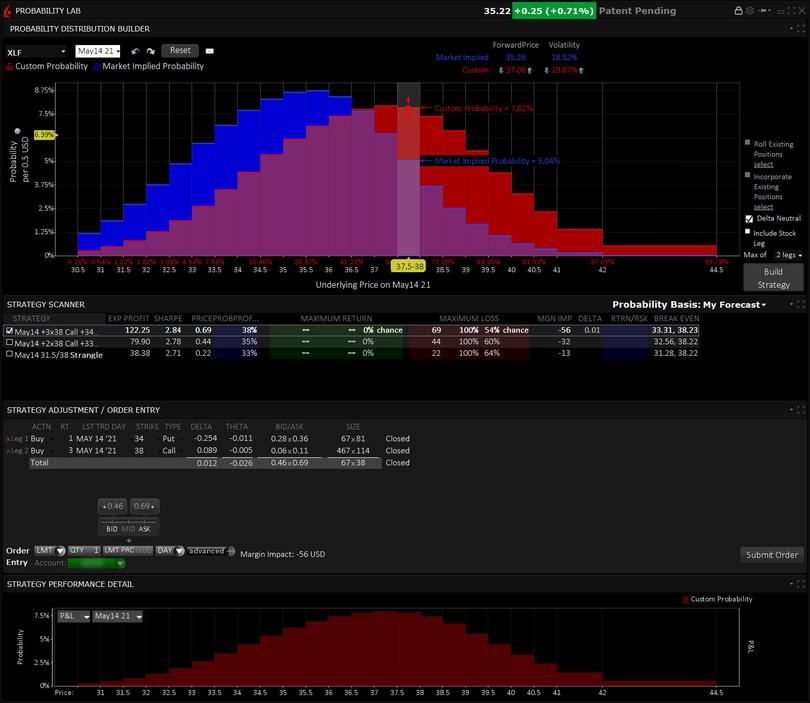

Probability Lab

Redefine the price and volatility outlook for an underlying stock or ETF, and identify potentially profitable options strategies, based on that view.

Volatility Lab

Gain a snapshot of past and future readings for volatility on a stock and its industry peers then compare and contrast the option market’s view on the volatility of a stock over the coming months.

Options Portfolio

Options Portfolio continuously and efficiently scours market data for low-cost option strategies to bring a portfolio in line with user-defined objectives for the Greek risk dimensions (Delta, Gamma, Theta and Vega).

Professional Trading Platforms

Mobile Options Trading

Stay on top of your portfolio and the markets wherever you are. The IBKR Mobile app includes everything you need to trade and manage your options on-the-go.

Desktop Options Trading

Trader Workstation (TWS) is designed for active options traders who trade multiple products and require power and flexibility. The integrated Model Navigator offers sophisticated options model pricing, while the Options Analytics window helps you understand the rate of change of an option’s price with respect to a unit of change for multiple risk dimensions.

Best for Advanced Traders

Best Online Broker

Start trading like a professional today!

Open an AccountDisclosures

* For complete information, see options market share. Supporting documentation for any claims and statistical information will be provided upon request.