TWS Workspace Layout Library

TWS Layout Library

Quickly create custom layouts using the Layout Library

Simplify your trading interface with custom-designed layouts. Quickly create a workflow-based or instrument-focused layout using a pre-defined layout from our comprehensive library. Create as many layouts as you need, and access them easily from the quick-click tabs along the bottom of TWS.

Overview

IB TWS is a robust, multi-asset, global trading system with myriad trading tools, algos, order types, analytics, research and more. Layouts allow you to customize your trading environment just the way you want. Create multiple, custom layouts and easily toggle between them using the tabs displayed along the bottom of the workspace. Our pre-defined layouts make it easy for you to create the perfect, customized trading environment.

Use the Layout Library

Add as many layouts to TWS as you need. Each layout is available as a tab along the bottom of the TWS frame, and all layouts can be customized.

Add a New Layout

To create a new layout, click the Add Tab "+" icon along the bottom of the Mosaic. Elect to use the Layout Library by clicking Open the Layout Library on the right side of the Add Tab dialog box.

Open the Layout Library

Select a Layout

Browse the Layout Library by scrolling through the layouts, or narrow your search by selecting a category from the list on the left. To find out more about any layout, click the layout’s Details button. To use a layout, click the Add Layout button. The new layout will open within a frame, and a new named tab for the layout appears along the bottom of TWS. The layout is ready to use!

If you need to, you can easily modify any layout by adding, removing and re-organizing the layout’s tools and tiles. Additionally, you can add multiple versions of the same layout. You can rename a layout by right-clicking the tab and selecting "Rename." If you add multiple versions of the same layout and elect not to rename, they will be identified by a numbered sequence in the tab names, for example "News" "News1" "News2" etc.

Add a Layout

Edit a Layout

Layouts are locked by default to avoid inadvertent moving or closing of tools. To make changes to your layout, you first need to unlock it by clicking the lock icon in the top right corner of the Anchor window. When you unlock the layout the outer border becomes bright green and the workspace is labeled "Layout Unlocked" in anchor window.

Unlock the Layout

Once the layout is unlocked, select a window to move or resize it. Click the "x" in the top right corner to delete it. Use the New Window drop down to find and add additional tools.

When you have finished editing, be sure to lock the layout. You will still be able to use it unlocked, but will not be able to log out until the layout has been locked.

Create a Layout from Scratch

You may have a solid idea of the workspace you want to create and would prefer to start with a blank palette and add your own tools.

Add a Blank Layout

To create a new blank layout, click the Add Tab "+" sign along the bottom of the Mosaic. Enter a name in the Enter Layout Name field on the left side of the Add Tab dialog box. A new tab for the layout is added to the tab set along the bottom of TWS, and the layout opens in "unlocked" mode.

Design your Layout

Use the New Window drop down to select tools to add to your layout. Drag and resize to design the layout. Once you are finished, remember to lock the layout. You can unlock and edit any layout at any time.

Create a Layout from Scratch

Available Library Layouts

We currently offer 22 pre-designed layouts which are described below.

Standard Mosaic

This broad-based, efficient workspace includes streaming news, charts and order management, and is designed to meet the needs of most traders.

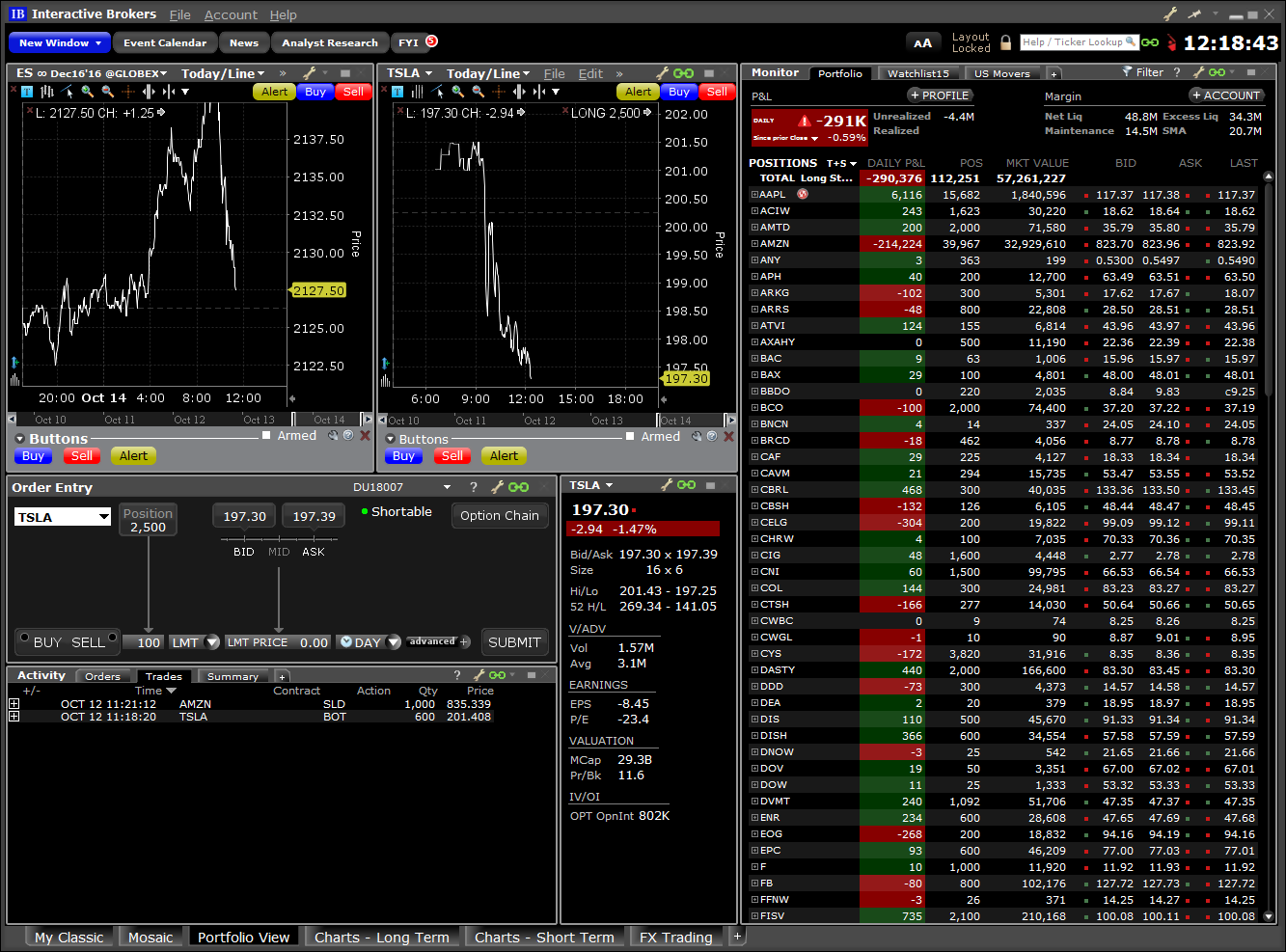

Order Entry with Portfolio

See at-a-glance account summary and position detail in your portfolio, and quickly trade any asset type. View today’s market performance side by side with any security in your portfolio.

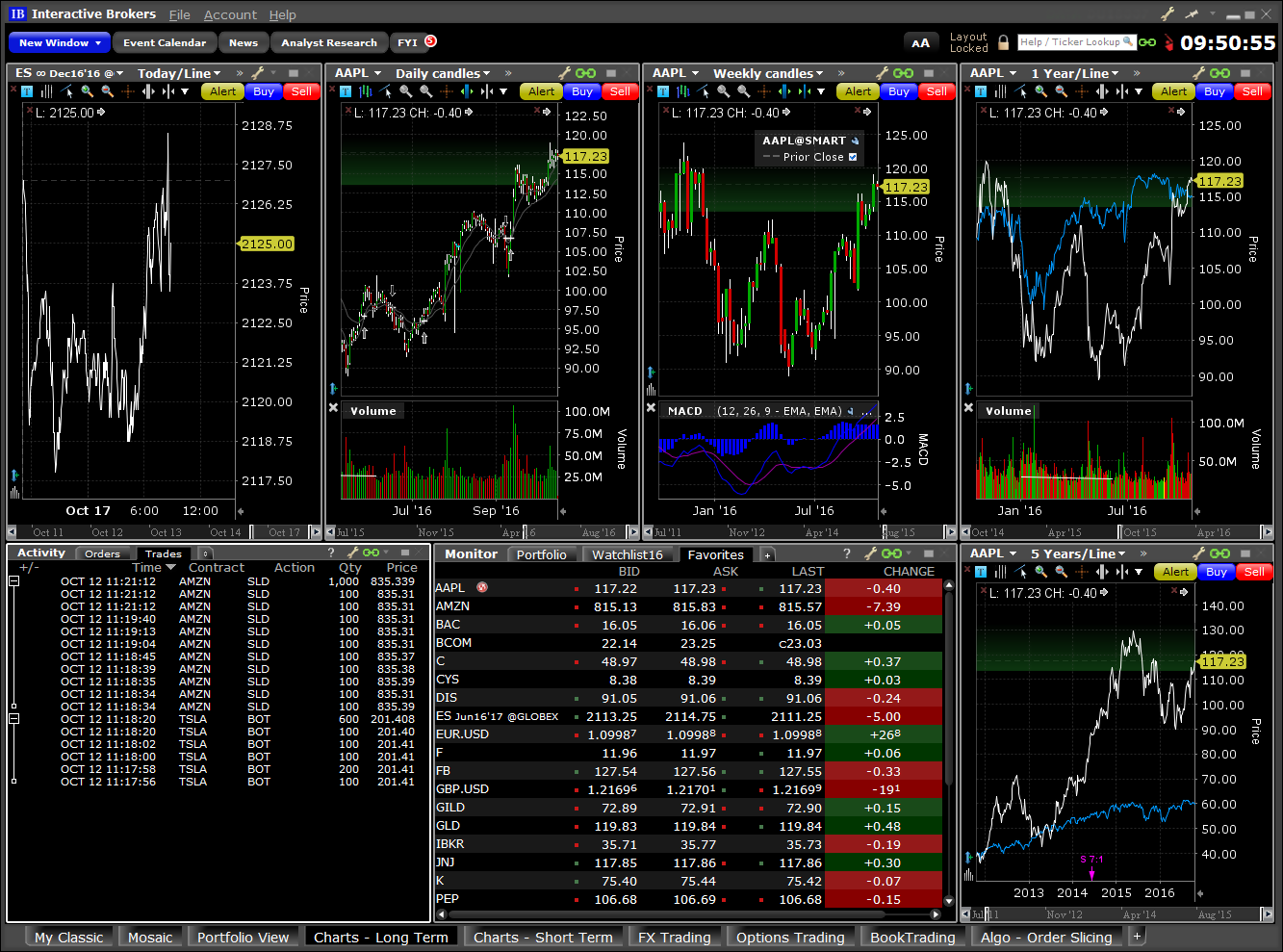

Chart Trading Long Term

A sequence of charts lets you compare today's market performance with longer-term performance on any asset. Trade with a single click at a price point in any chart.

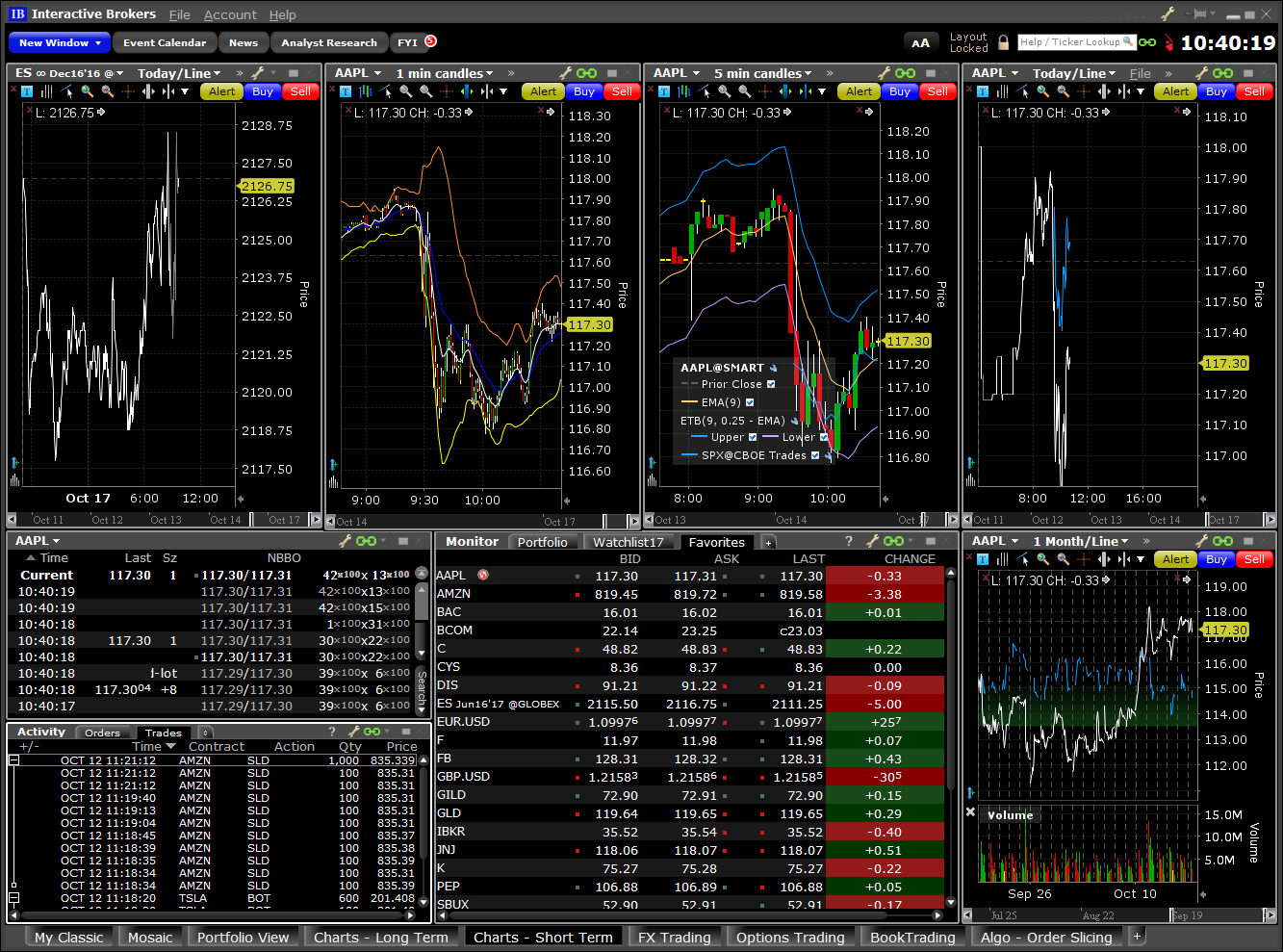

Chart Trading Short Term

A sequence of charts lets you compare today's market performance with short-term performance on any asset. Trade with a single click at a price point in any chart.

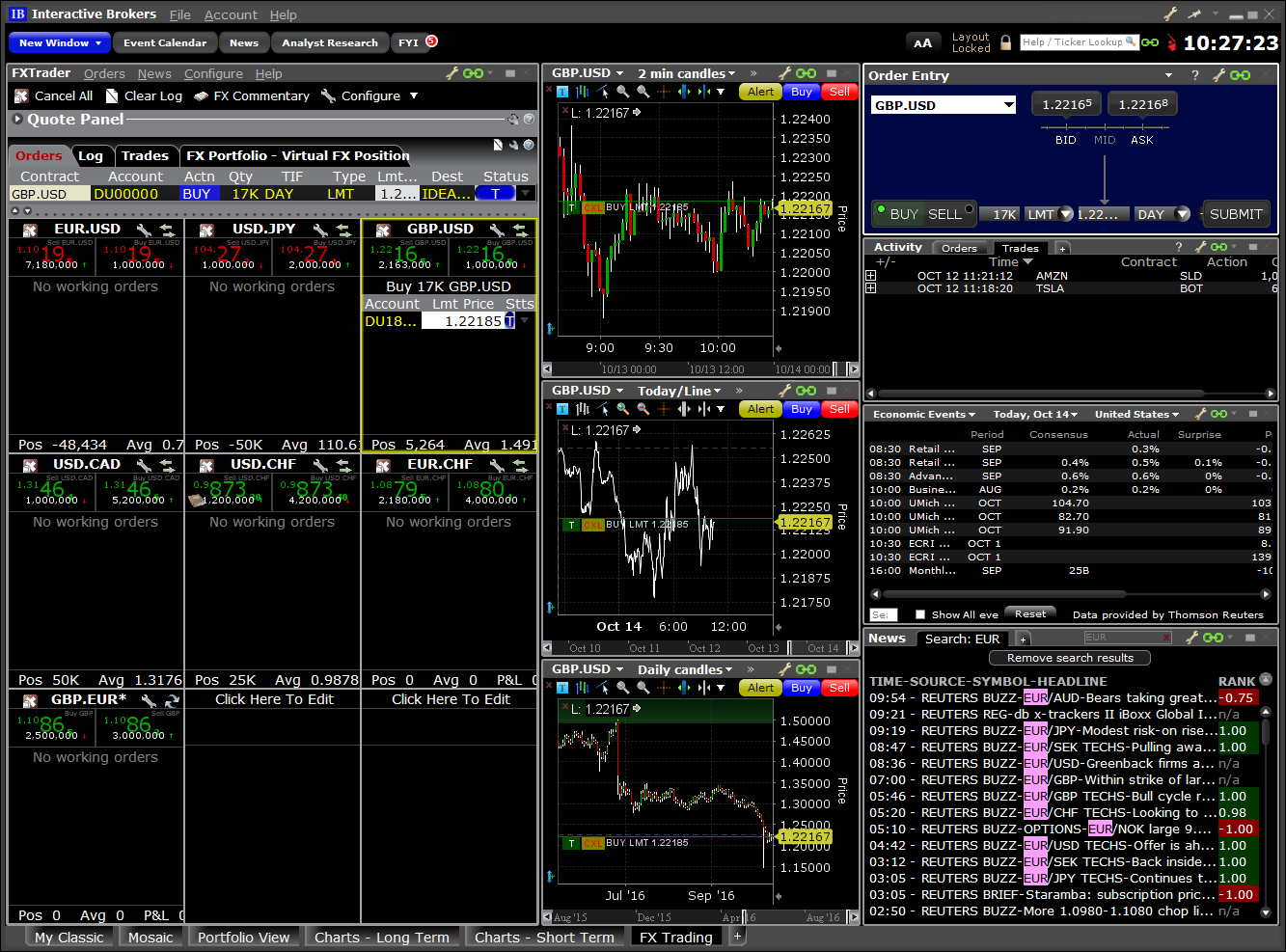

Currency Trading

Create currency spot and futures orders with a single click from the FXTrader, preconfigured with popular currency pairs and futures. Stay on top of economic events and currency news with event calendars and streaming news feeds.

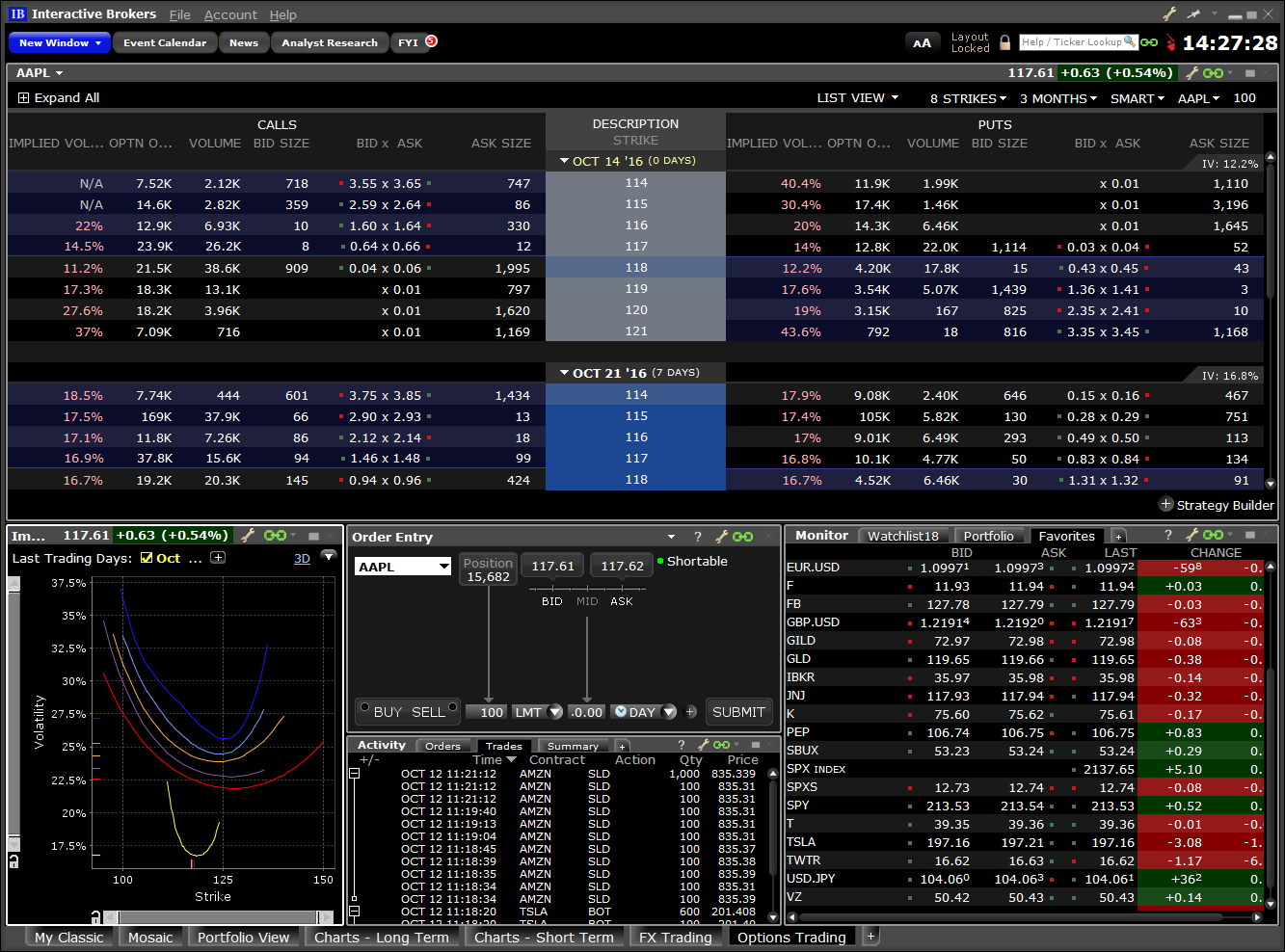

Option Trading

Quickly create single orders or complex option strategies using the OptionTrader.

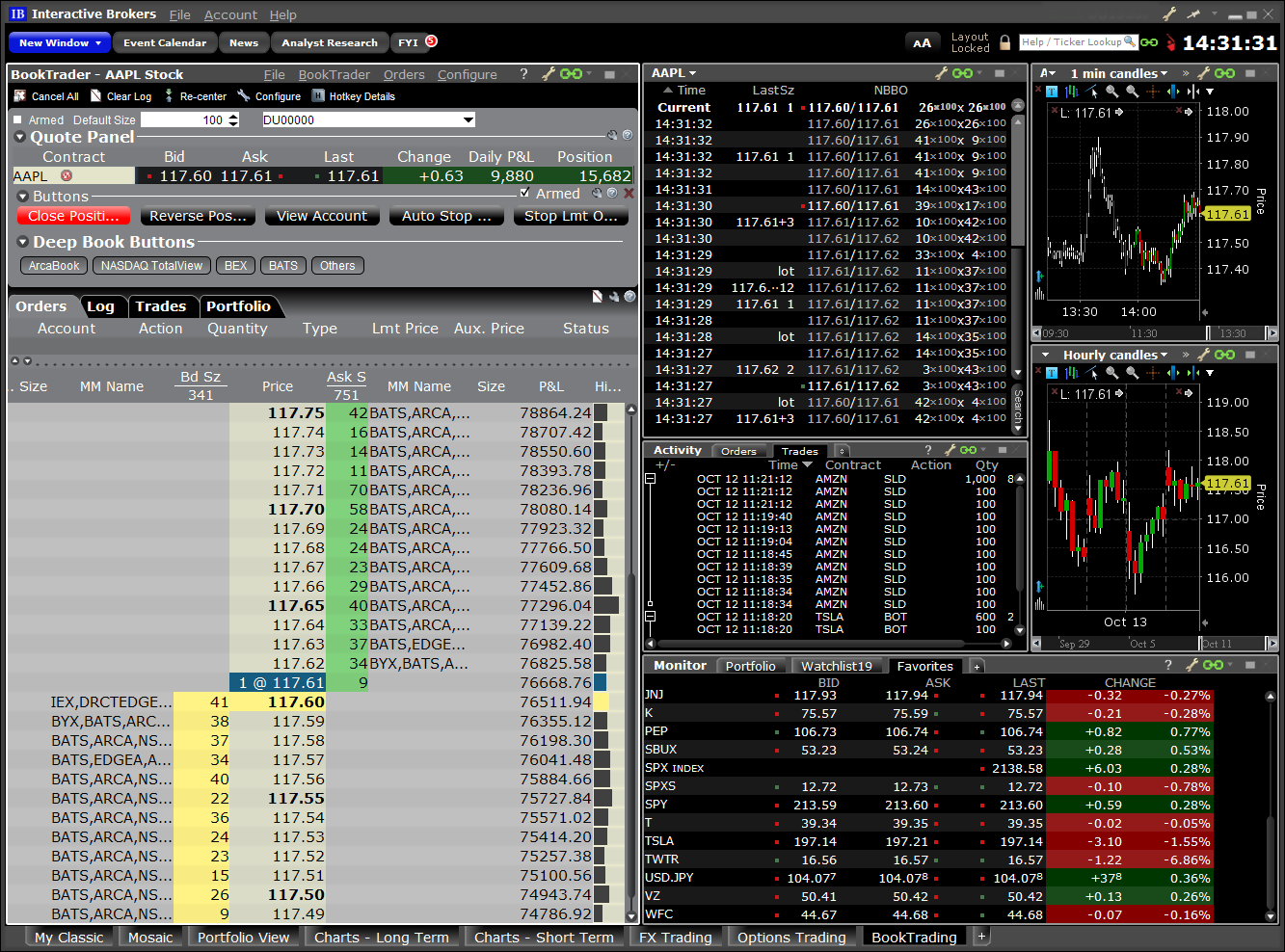

Book Trading

Create orders for a single instrument from the BookTrader "price ladder." Attached tools help you quickly select the asset you want to trade.

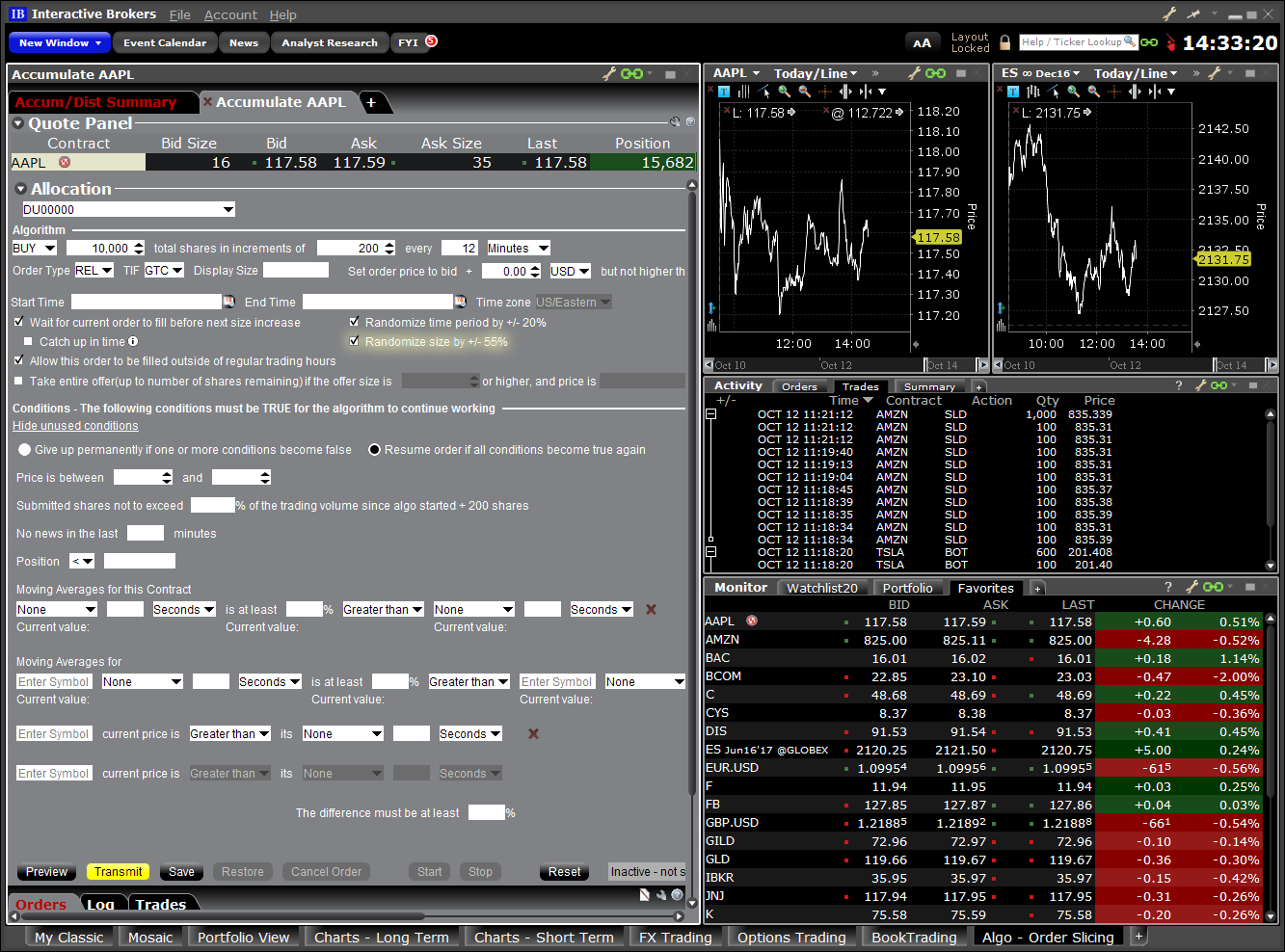

Algo - Order Slicing

The Accumulate/Distribute algo provides a step-by-step interface to help you create and manage multiple large-quantity orders - all with minimal market impact.

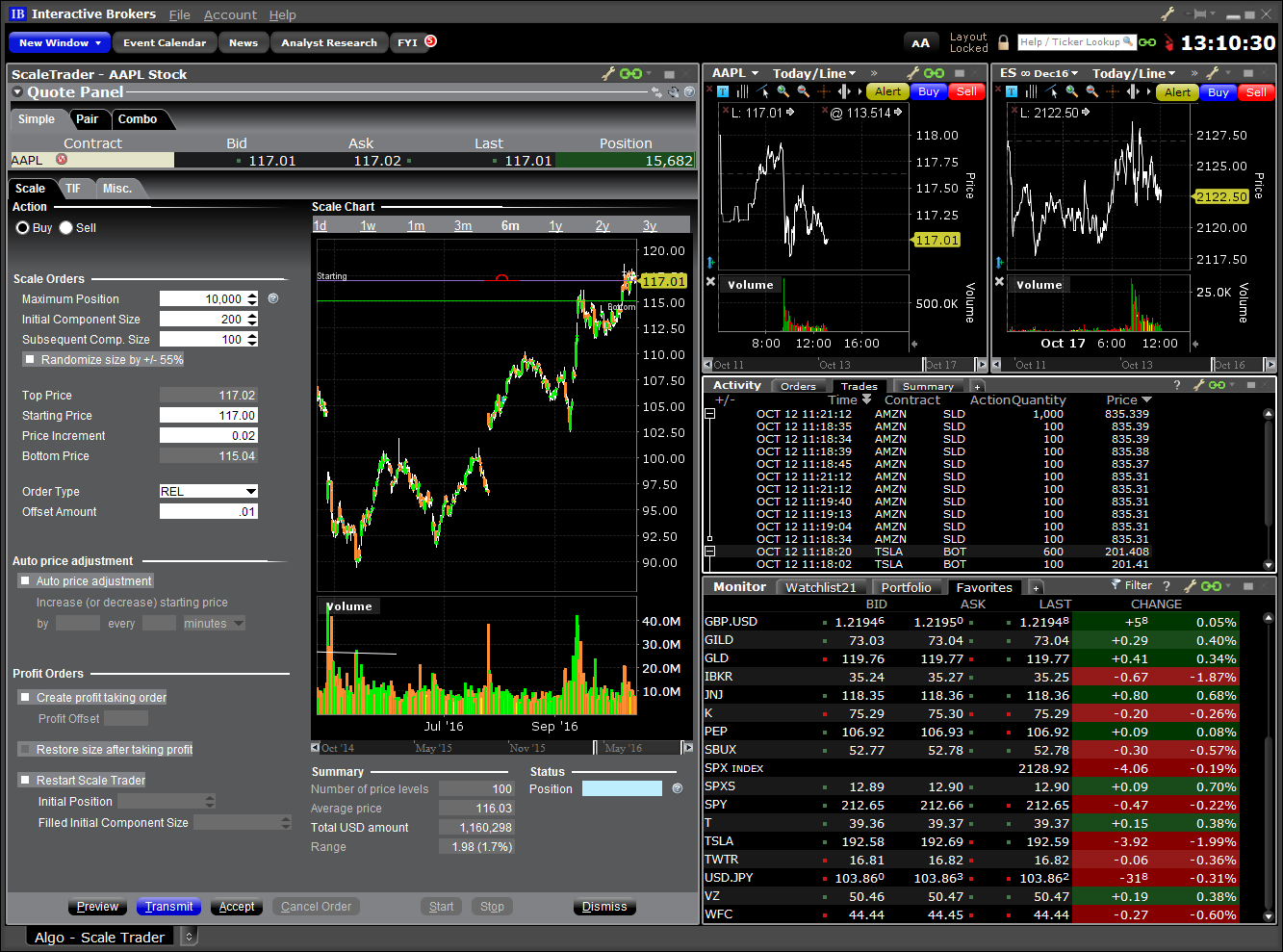

Algo – ScaleTrader

The ScaleTrader algo, alongside multiple charts and data tools, can help you scale into or out of large single positions and pair trades with minimal market impact.

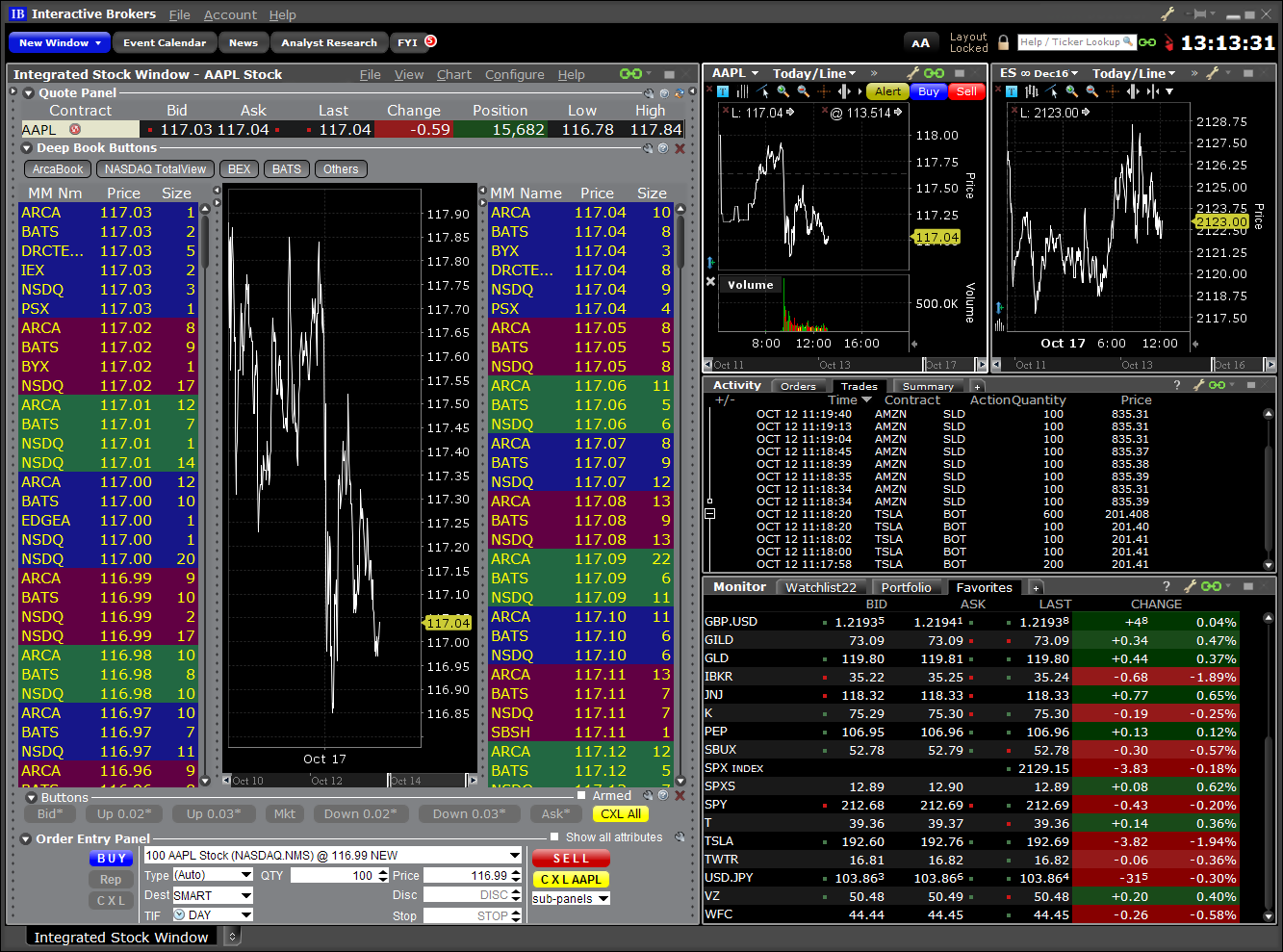

Integrated Stock Window

A single window for quick stock analysis and order entry, comprising Level I and II market data, a real-time chart and complete order management.

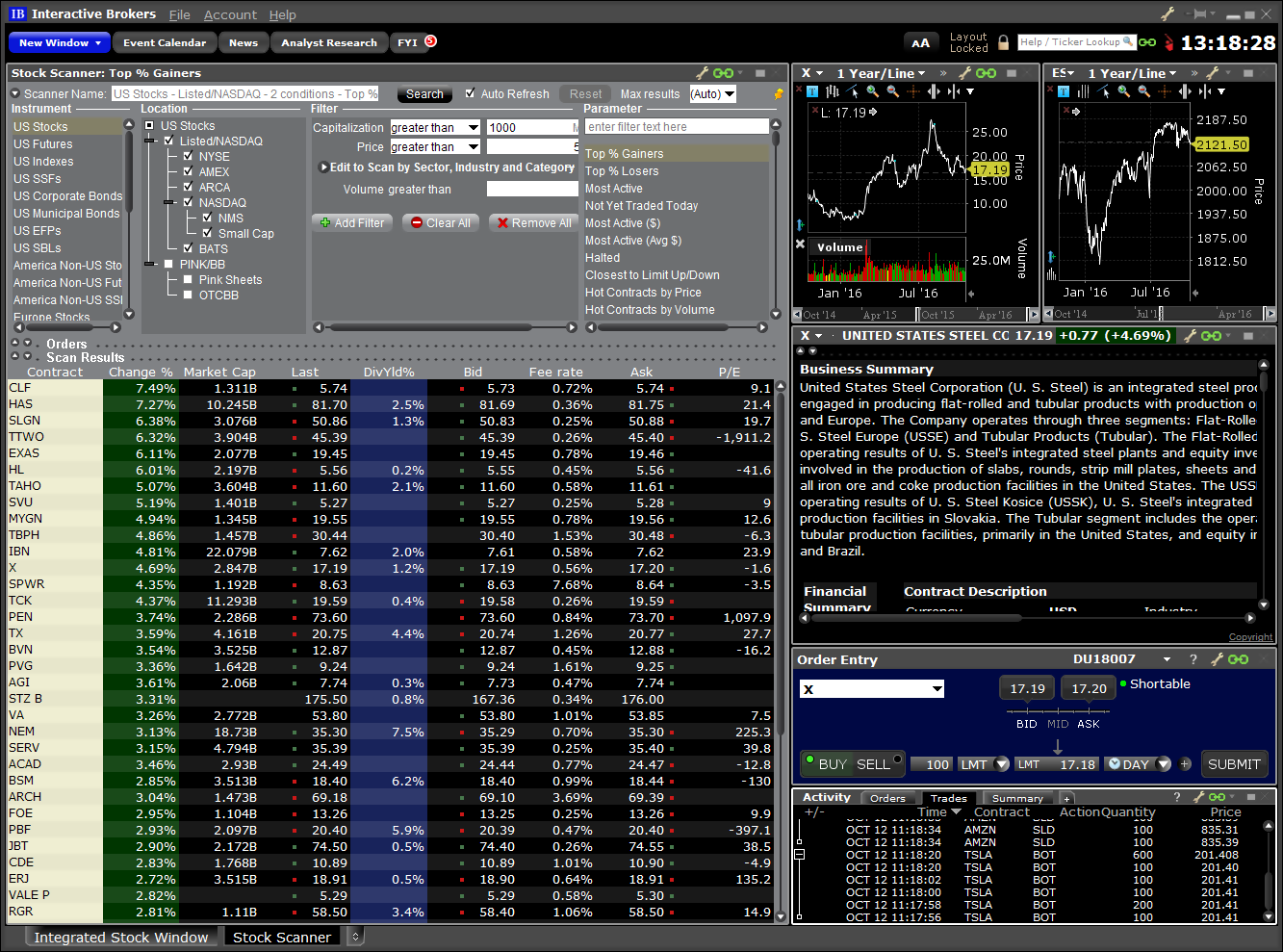

Stock Scanner

Scan the markets for new opportunities with this completely customizable scanner. See comprehensive research, and check key fundamentals and analyst forecasts before you make your decision. When you're ready, easily submit, monitor and manage your orders.

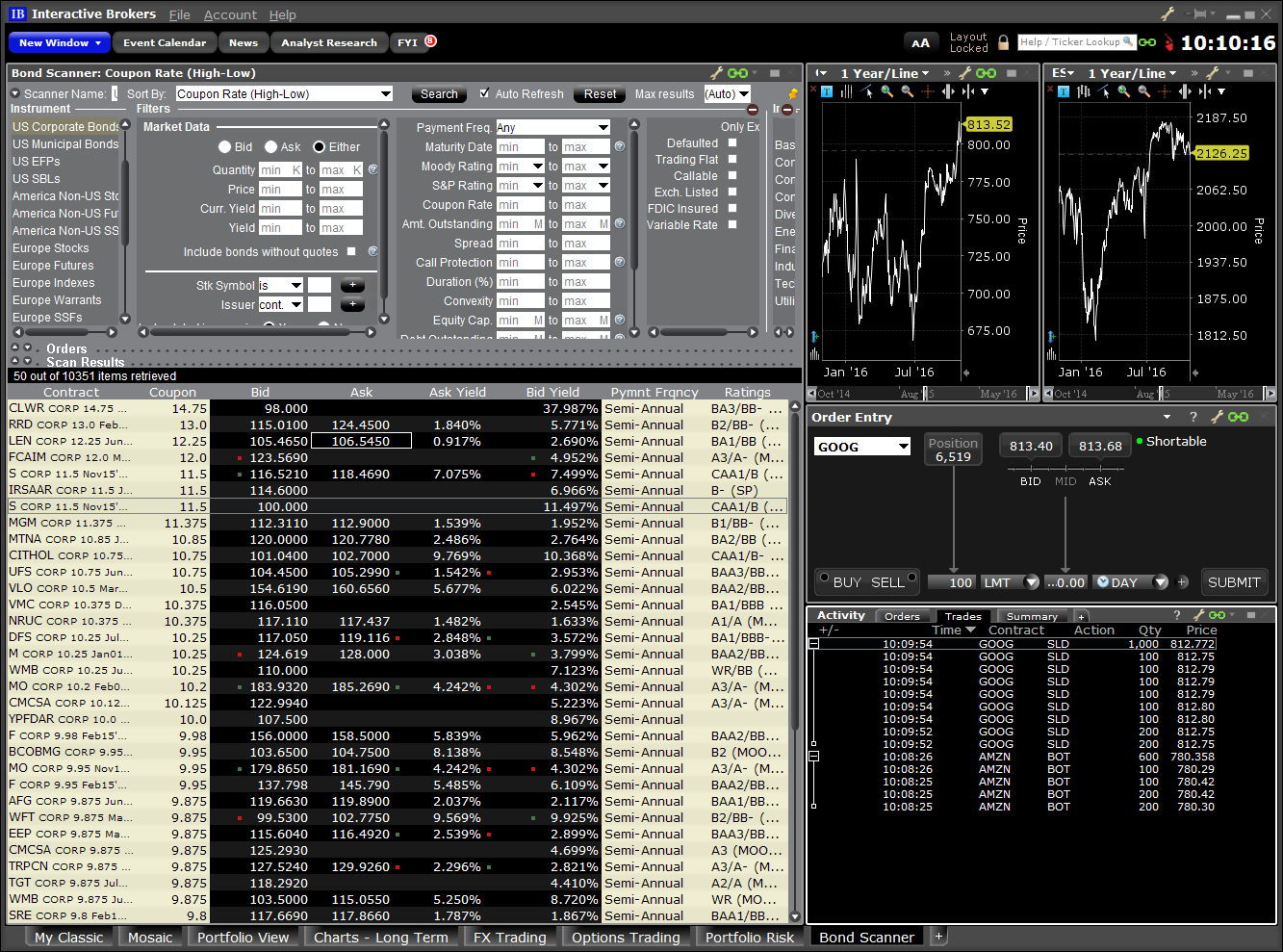

Bond Scanner

Scan the markets for fixed income investments with this completely customizable bond-specific scanner. See comprehensive research, and check key fundamentals and analyst forecasts before you invest in corporate bonds. When you're ready, easily submit, monitor and manage your orders.

Markets

Stay on top of activity in the world markets with a comprehensive Watchlist of world indices and an up-to-the-minute list of Top Movers throughout Europe, Asia and the US.

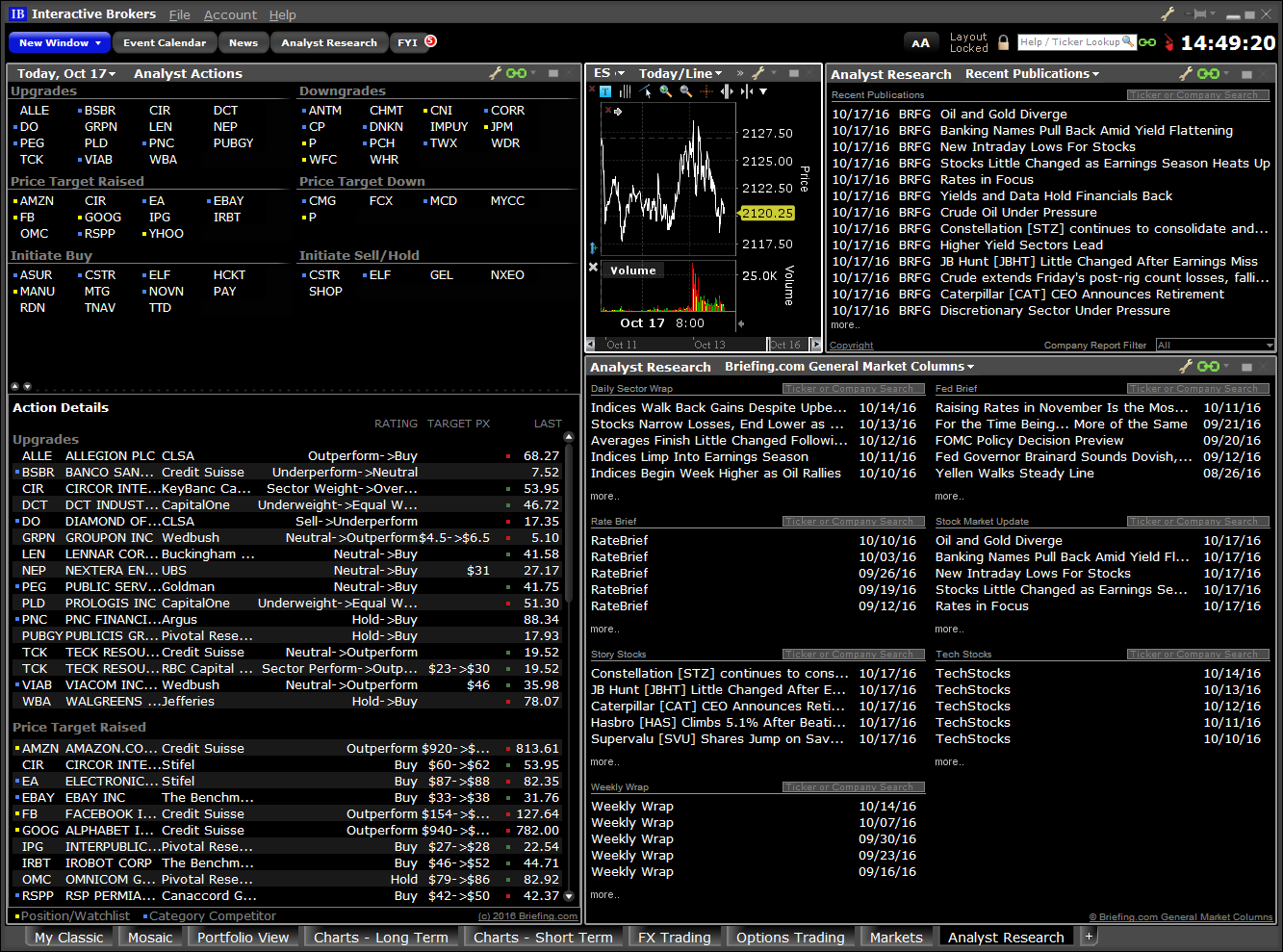

Analyst Research

Quickly see today's analyst upgrades and downgrades, along with several analyst research publications that are available to IB clients at no additional cost.

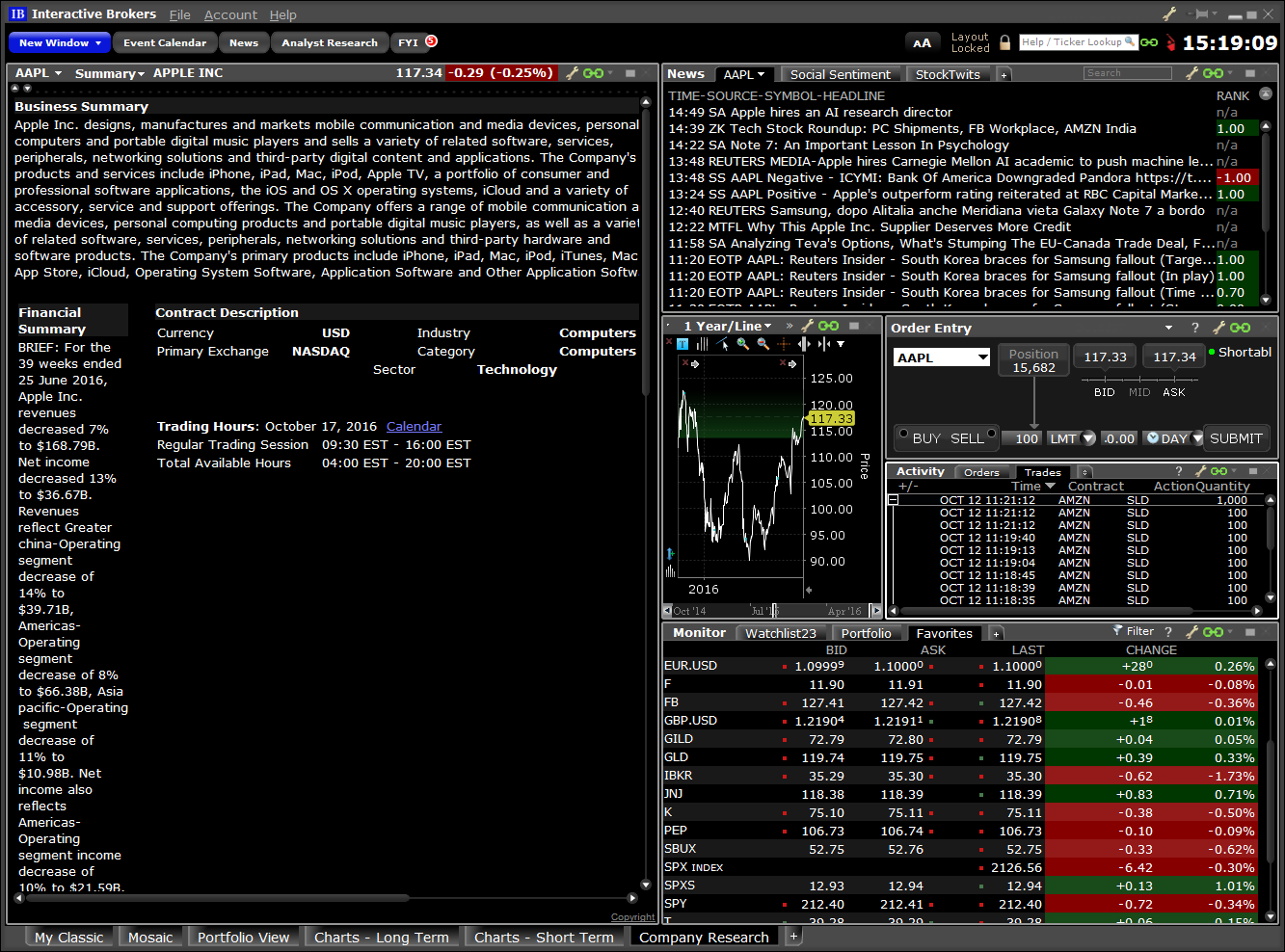

Company Research

Complete company research fundamentals at your fingertips. Summary, analyst forecasts, financial statements and other company fundamentals data.

News

A complete list of news sources including the Street Insider Top News, Bloomberg TV, IB's own Traders' Insight, portfolio news and more. All with social sentiment and confidence ratings.

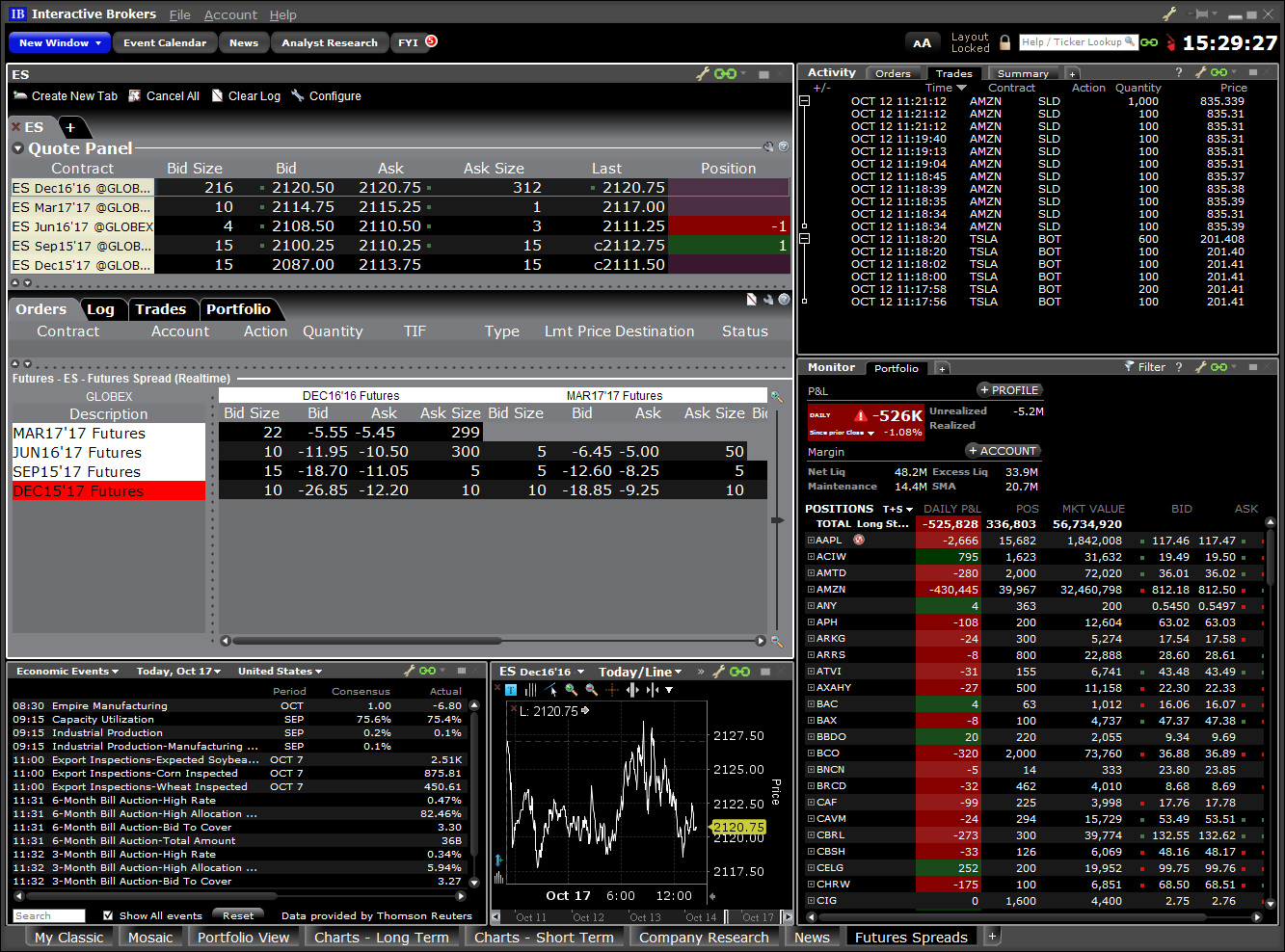

Future Spreads

Use the SpreadTrader to trade in futures, futures options, EFPs and option combinations using pre-built strategies like the calendar spread, butterfly, collar, iron condor, straddle, strangle and more.

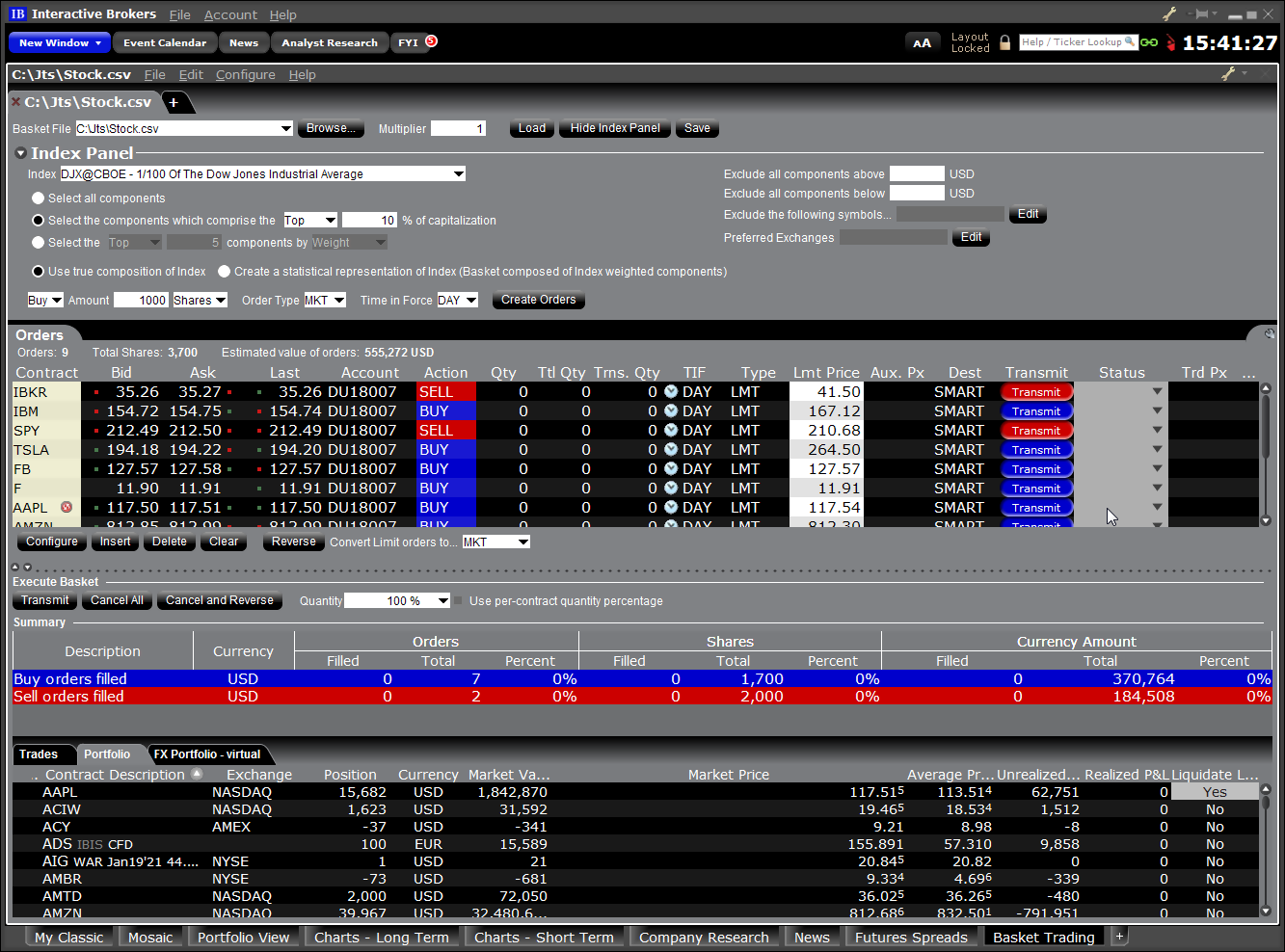

Basket Trading

Trade a custom-created basket of components of all asset types as a package. Or, choose a popular index to replicate in your basket.

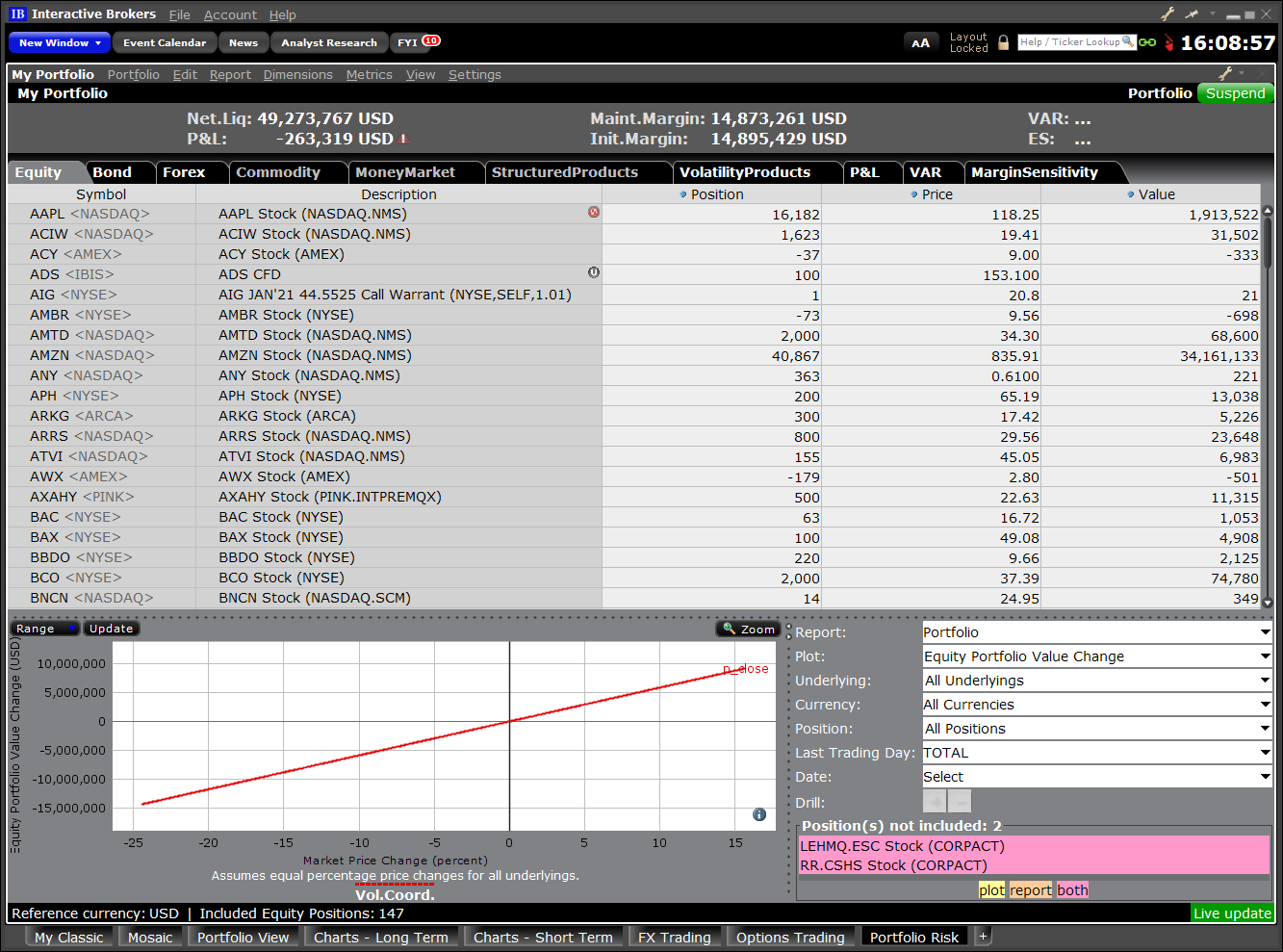

Portfolio Risk

Use the real-time market risk management tool to see a comprehensive measure of risk exposure across multiple asset classes, and to assess specific risk slices of your portfolio, such as risk by position, risk by underlying and risk by industry.

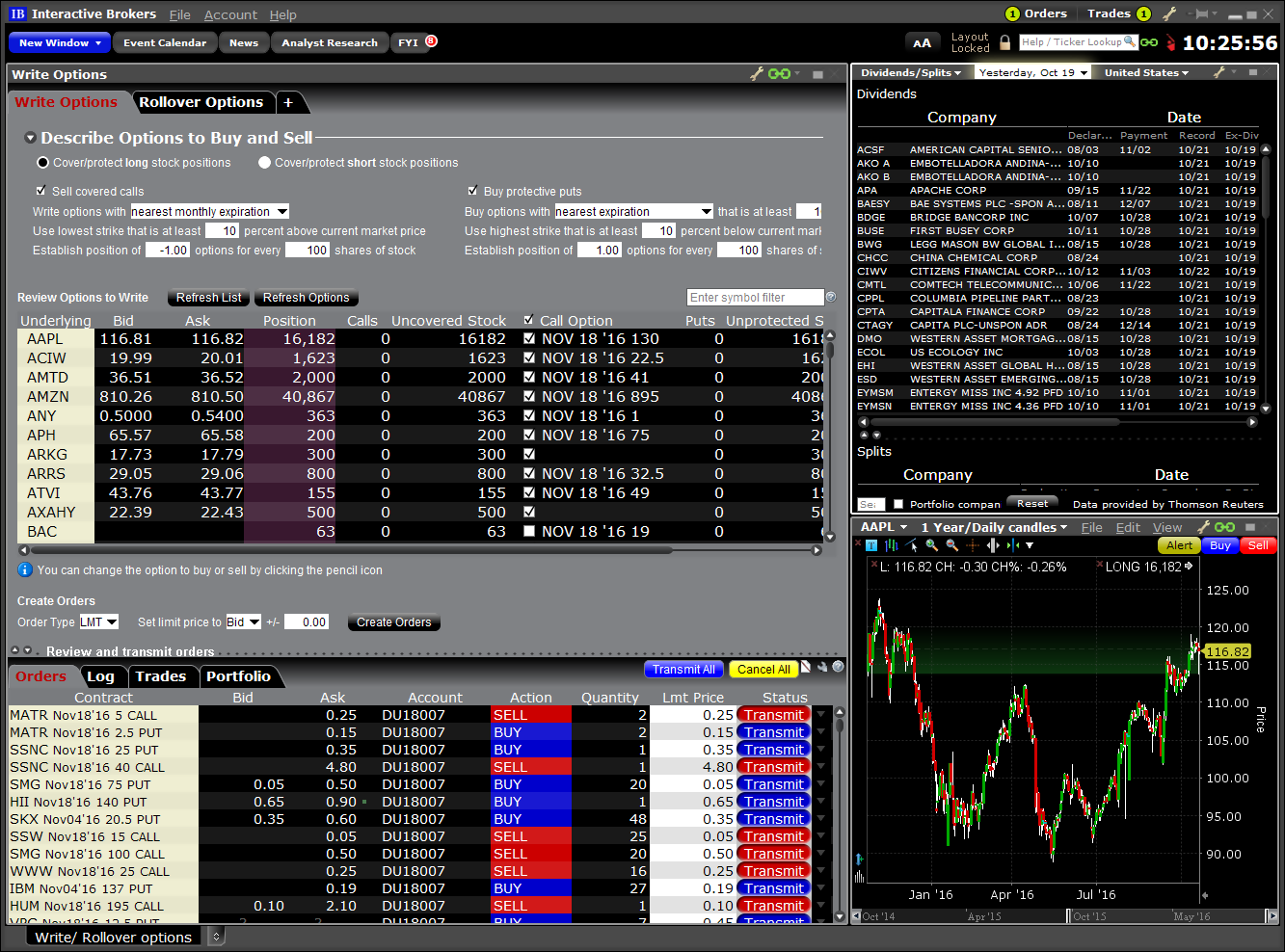

Write/Rollover Options

Use our intuitive Write Options interface to sell calls against long stock positions and sell puts against your short positions. Use the Rollover Options tool to quickly roll over options that are about to expire.

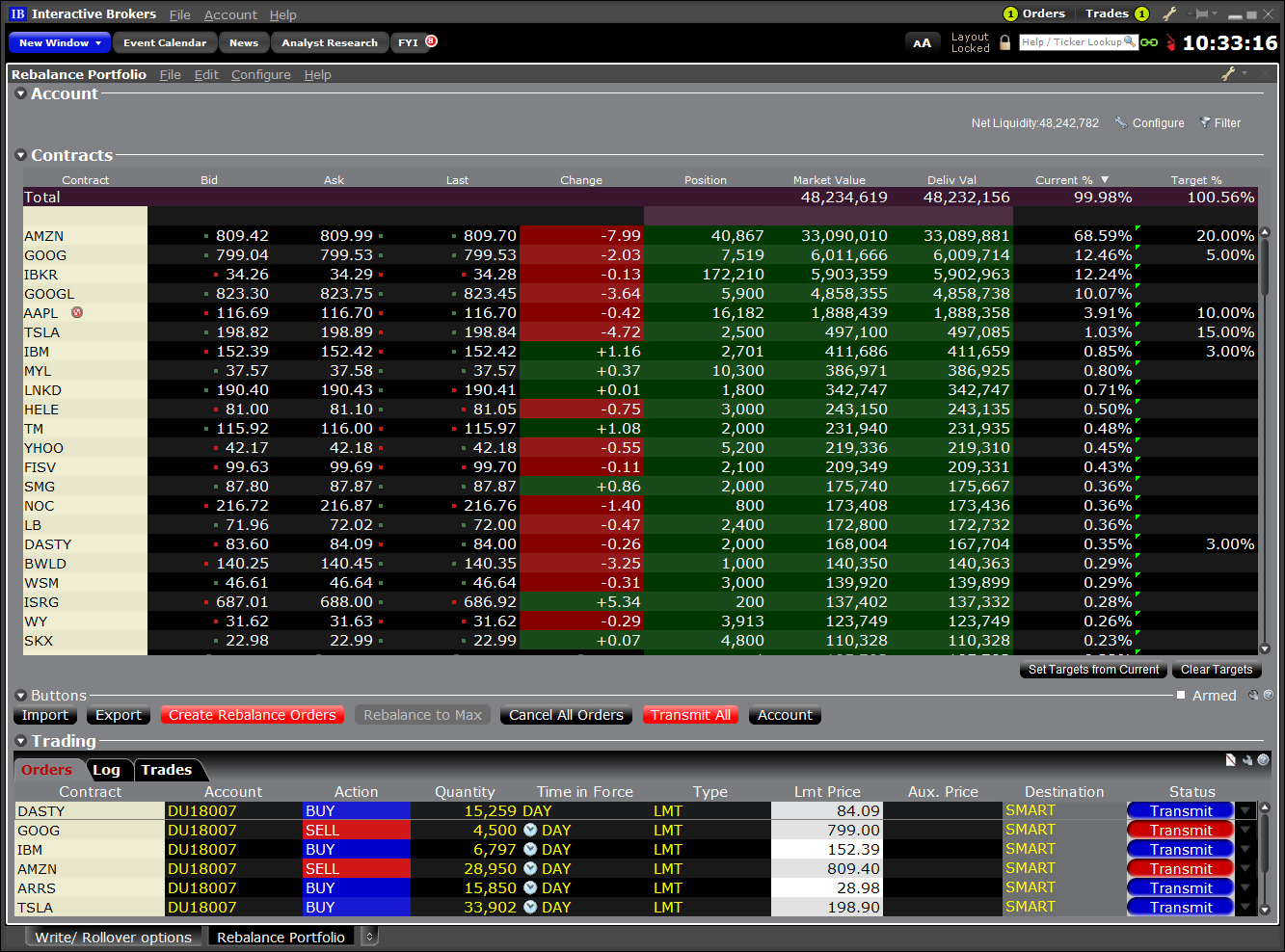

Rebalance Portfolio

The Rebalance Portfolio tool makes it easy to realign your portfolio based on your investment goals and risk tolerance. Advisors can use the tool to quickly rebalance all or some of their client accounts.