Social Market Analytics’ (SMA)

See How the Market Feels

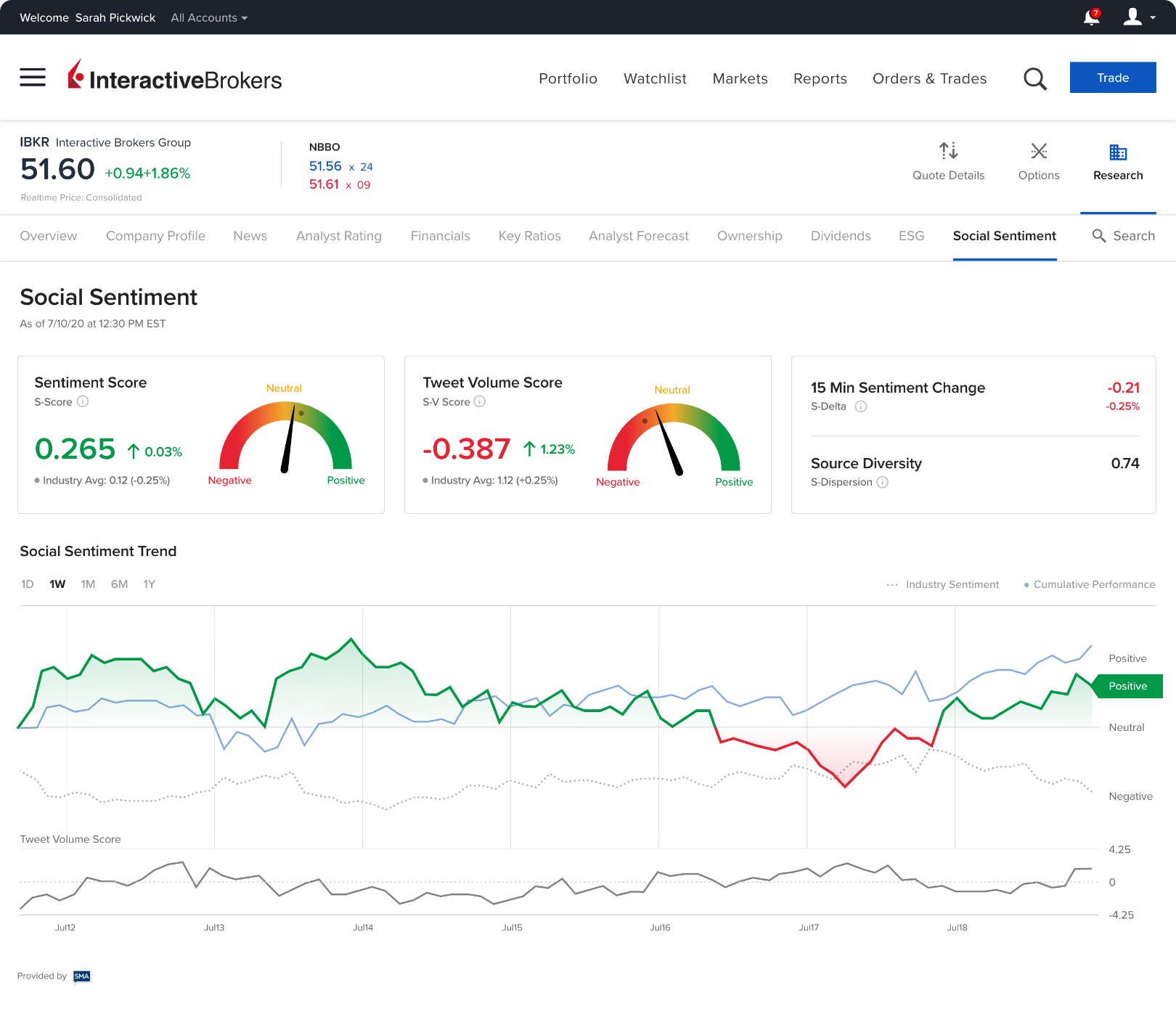

Spot positive and negative changes in investor attitudes with Social Market Analytics’ (SMA) patented social sentiment processing technology.

Turning Chatter Into Insights

With their patented scoring methodology, SMA gathers, filters and analyzes social media commentary to quantify sentiment for financial products. Whether it’s the most talked-about company, or one that’s rarely discussed, normalized sentiment and sentiment volume scores provide a valid comparison between all SMA-supported products.

Why Sentiment Matters

Case studies by SMA show a correlation between changes in investor sentiment and changes in price. Our easy-to-use interface lets you see where social sentiment for a product is now, how it compares to other companies in the same industry, and how it has changed over time.

Monitor the Market’s Mood

See Social Sentiment Scores in easy-to-read, color-coded data columns you can add to your Watchlists and Portfolio. Or, scan for top products based on Volume and Sentiment scores and score changes using our market scanners.

USER GUIDES

Get Started with Social Sentiment by Social Market

Analytics (SMA)

For more information on Social Sentiment by Social Market Analytics (SMA), select your trading platform.

Disclosures

Social Media Analytics (“SMA”) is a third-party analytics provider and is not affiliated with Interactive Brokers LLC (“IBKR”). As such, IBKR makes no warranties as to the accuracy of the data provided by SMA. For more information about SMA and how it analyzes data please see (White Paper). This material is for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.