Trailing Market if Touched

A trailing market if touched order is entered on the same side of the market as a limit order. This order will initially be set at a price level that is favorable to the current market. As the market moves away from the initial trigger price, the user defined trailing amount will adjust the trigger price to follow the market. If the initial market movement is in a favorable direction and reaches the initial trigger price, the order will be triggered and submitted as a market order for execution. If the market moves in an unfavorable direction, the order will trail the market movement and will trigger only if there is retracement by the defined trailing amount (for falling markets, retracement is when the market declines followed by an increase to levels previously traded; for rising markets, retracement is when the market rises followed by a decrease to levels previously traded).

Buy Order

A buy trailing market if touched order moves with the market price, and continually recalculates the trigger price at a fixed amount below the market price, based on the user-defined "trailing" amount. The limit price is also continually recalculated based on the limit offset. A trailing market if touched order is similar to a trailing stop order, except that the buy order sets the initial stop price at a fixed amount below the market price instead of above. As the market price rises, the trigger price rises by the user-defined trailing amount, but if the price falls, the trigger price remains the same. When the trigger price is touched, a market order is submitted.

Sell Order

A sell trailing market if touched order moves with the market price, and continually recalculates the trigger price at a fixed amount above the market price, based on the user-defined "trailing" amount. The limit price is also continually recalculated based on the limit offset. A trailing market if touched order is similar to a trailing stop order, except that the sell order sets the initial stop price at a fixed amount above the market price instead of below. As the market price falls, the trigger price falls by the user-defined trailing amount, but if the price rises, the trigger price remains the same. When the trigger price is touched, a market order is submitted.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Bonds | US Products | Smart | Attribute | ||||

| EFPs | Non-US Products | Directed | Order Type | ||||

| Forex | Time in Force | ||||||

| Funds | |||||||

| Futures | |||||||

| FOPs | |||||||

| Options | |||||||

| Stocks | |||||||

| Warrants | |||||||

| Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

Example

Order Type In Depth - Trailing Market if Touched Buy Order

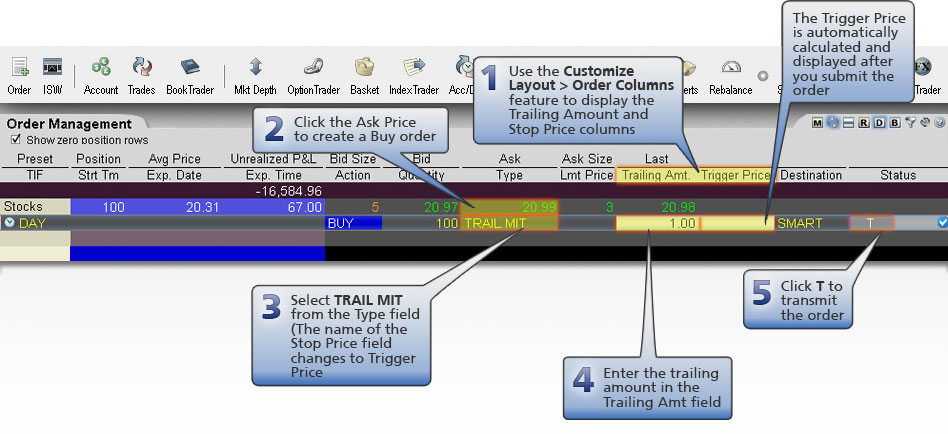

Step 1 – Enter a Trailing Market if Touched Order

You want to purchase 100 shares of XYZ in a rising market. First, configure the layout to display the Trailing Amt and Stop Price fields. Next, set a trailing market if touched order with the trailing amount $1.00 below the current market price. To do this, first create a BUY order, then select TRAIL MIT in the Type field and enter 1.00 in the Trailing Amt field. The trailing amount is the amount used to calculate the initial stop price. Note that as soon as you select the order type, the name of the Stop Price field changes to Trigger Price. You submit the order.

Step 2 – Order Transmitted

You transmit your order. The current market price of XYZ is $20.99 and the initial stop price is calculated as $19.99, or $20.99 – the trailing amount of 1.00.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | TRAIL MIT |

| Market Price | 20.99 |

| Trailing Amount | 1.00 |

| Stop Price (Calculated as Market Price – Trailing Amount) | 19.99 |

Step 3 – Market Price Rises

As soon as you submit your order, the price of XYZ starts to rise and hits $22.00. The trailing stop price has adjusted accordingly and is at $21.00, or $22.00 – the $1.00 trailing amount.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | TRAIL MIT |

| Market Price | 22.00 |

| Trailing Amount | 1.00 |

| Stop Price (Calculated as Market Price – Trailing Amount) | 21.00 |

Step 4 – Market Price Falls

Suddenly the market price of XYZ drops to 21.50. Your Stop Price remains at 21.00. If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to buy 100 shares of XYZ will be submitted.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | TRAIL MIT |

| Market Price | 21.50 |

| Trailing Amount | 1.00 |

| Stop Price | 21.00 |

Step 5 – Market Price Touches Stop Price, Market Order Submitted

The market continues to fall and the market price of XYZ falls to the stop price of 21.50. A market order is automatically submitted and filled at that price.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | TRAIL MIT |

| Market Price | 21.50 |

| Trailing Amount | 1.00 |

| Stop Price | 21.50 |

| Market order filled at $21.00 | |