Fractional Trading

Build a Balanced Portfolio with Fractional Shares

Invest in the stocks you want regardless of share price.

Open Account Try On Our Platforms

Already have an account? Enable Fractional Trading

Why Trade Fractional Shares with Interactive Brokers?

| Brokers | US Fractional Shares Available1 | |

|---|---|---|

| IBKR | 10,500 | + |

| Fidelity | 7,000 | + |

| Schwab | 500 | |

| E-Trade | 0 | |

[1] Fractional shares available for purchase as of January 1, 2025. Source: Bankrate

“IBKR offers access to an industry-leading selection of fractional investments.”

Investopedia.com

No Stock is Too Expensive

Pick any eligible US, Canadian or European stock (or ETF, where available) and decide how much you want to invest - it's that easy. If the purchase price doesn't result in a whole number of shares, we'll buy or sell fractional shares.

| STOCK | SHARE PRICE2 | AMOUNT INVESTED | FRACTIONAL SHARE % |

|---|---|---|---|

| META | $627.08 | $25 | 3.99% |

| GOOG | $291.74 | $25 | 8.57% |

| MSFT | $508.68 | $25 | 4.91% |

| NFLX | $1,136.44 | $25 | 2.20% |

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

[1] Share prices as of November 11, 2025.

Get More for Your Money

With fractional shares you can divide your investments among more stocks to achieve a more diversified portfolio, and put small cash balances to work quickly to maximize potential returns!

What Are Fractional Shares?

Fractional shares represent portions of a whole share of a company’s stock or an exchange-traded fund (ETF). Instead of purchasing an entire share, investors can buy a fraction, allowing them to invest amounts that align with their financial goals. For example, if a single share costs $100, an investor with $50 can acquire 0.5 shares. This approach makes higher-priced securities accessible to a broader audience.

What are the Benefits of Fractional Shares?

The benefits of fractional shares trading include:

Accessibility to Higher-Priced Stocks

Investors can own portions of expensive stocks or ETFs without needing substantial capital.

Portfolio Diversification

Fractional shares trading allows investors to diversify their portfolios more effectively, helping to diversify risks.

Efficient Use of Capital

Fractional shares trading enables the full utilization of available funds, minimizing idle cash and maximizing potential returns.

Facilitation of Dollar-Cost Averaging

Investors can consistently invest in set amounts over time, smoothing out the effects of market volatility.

Interactive Brokers’ Fractional Shares Education and Resources

Fractional shares allow IBKR clients to allocate a sum of money when investing stocks rather than buying a specific number of shares. Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on fractional shares and their role in accessing higher-priced stocks, portfolio diversification, the efficient use of capital and facilitating dollar-cost averaging.

This lesson and short video reviews how to configure your account for fractional shares trading and the steps to follow when investing your preferred amounts in shares of stocks or ETFs.

Additional Resources on Fractional Trading

USER GUIDES

Get Started with Fractional Trading

For more information on Fractional Trading, select your trading platform.

FAQ About Fractional Trading

Try Fractional Trading Today

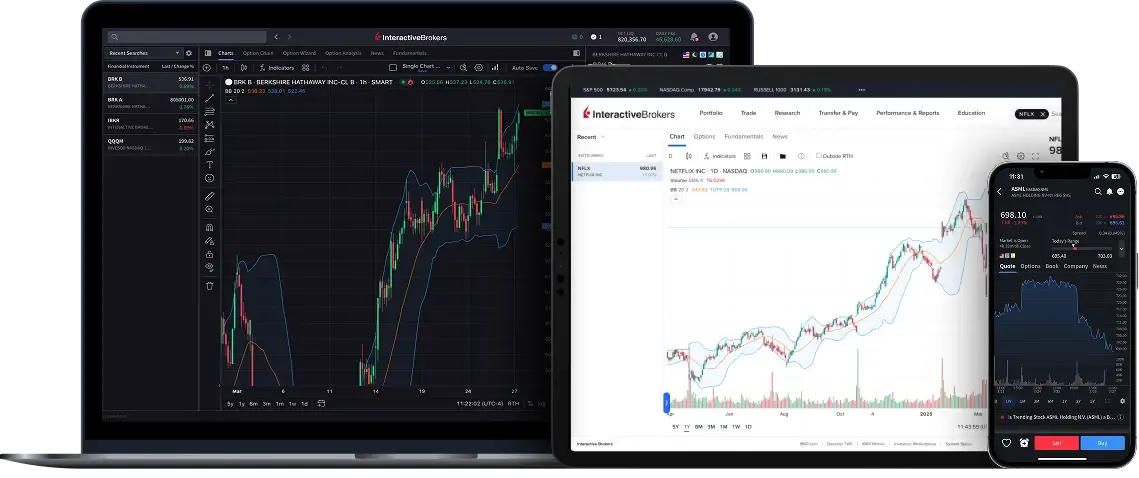

Available on all platforms.

Open Account Try On Our Platforms

Already have an account? Enable Fractional Trading

Disclosures

- Fractional shares available for purchase as of January 1, 2025. Source: Bankrate

- Share prices as of November 11, 2025.

- Interactive Brokers may close fractional share positions in stocks no longer eligible for fractional trading at any given time.

Change Cookie Settings

YouTube videos set Functional Cookies. You have rejected Functional Cookies. In order to watch this video you must accept Functional Cookies.