IBKR Trading API Solutions

API Solutions

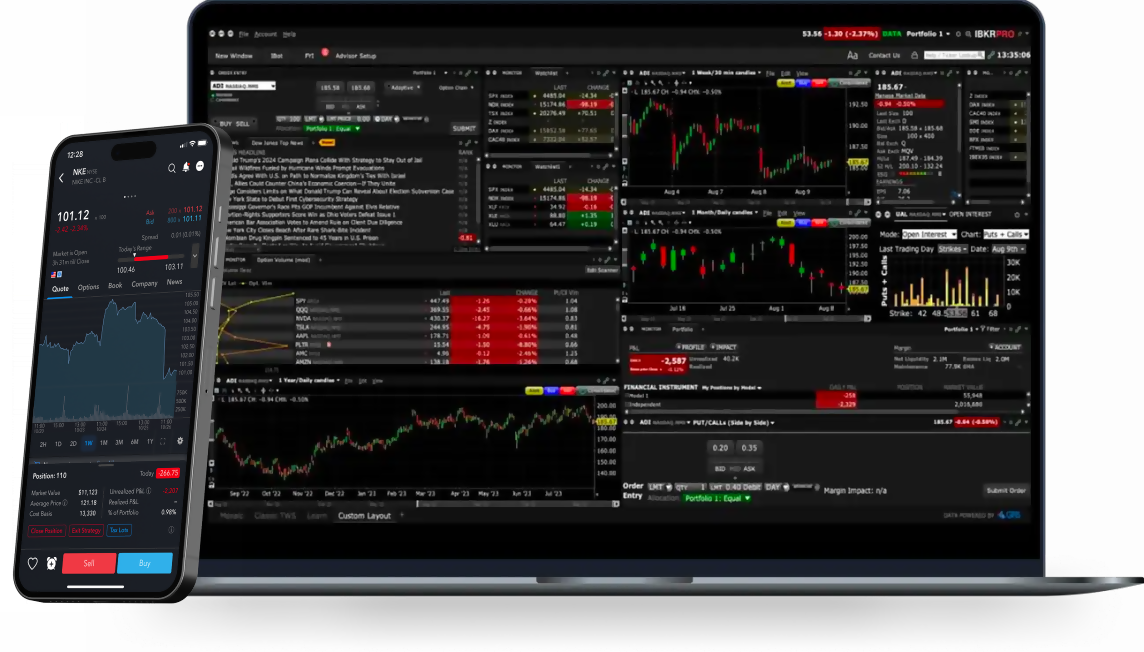

Use IBKR APIs to integrate global markets with your workflows.

Unlock the full potential of your trading experience by accessing global markets with IBKR APIs. Our APIs provide individuals, institutions, Fintechs and enterprise clients with robust trading, account management and account reporting features. Start integrating today.

The IBKR Advantage

- Trade stocks, options, futures, currencies, bonds, funds, and more across 160 markets in 36 countries.

- Access all the features of your IBKR account including margin/short selling and high yield on cash positions.

- Access real-time account and performance data including position and margin information.

- Stream real-time and historical market data.

Unlock the Power of IBKR's APIs

- Building a new mobile, web or desktop application.

- Integrating new trading capabilities into your current technology stack or trading platform.

- Automate algorithmic trading strategies, advanced programmatic investing or trading systems.

- Programmatically place orders including advanced order types and algos and trade in extended/overnight trading hours.

- Design completely custom account opening and trading experiences.

- Digitally manage accounts including funding and position transfers (institutions only).

- Build custom code to trade and interact with your IBKR account.

Our API Offerings

We offer clients a choice in their API selection. Use features from one API or many depending on our client's needs.

Web API

Our modern REST API offers access to our largest breadth of capabilities. This includes account opening, account management, funding, banking, reporting, as well as trading. Access various accounts for individuals and sub-account architecture for financial advisors. WebSocket streaming for real time capabilities such market data, critical notifications, and more.

Web API DocumentationFIX

IBKR's FIX connection lets institutions create trading systems to take advantage of our high-speed order routing and broad market depth. IBKR's industry standard FIX connection provides a direct and scalable solution to our trading system by using a VPN, extranet, leased line or Cross-connect connection.

FIX API DocumentationTWS API

Our trading oriented API allows you to develop applications in C++, C#, Java, Python, ActiveX, RTD or DDE. Utilize prebuilt libraries to automate features in TWS UI or develop your own interface. Users can consider this if they want to use the client gateway in order to access higher trade volume while using less bandwidth.

TWS API DocumentationAdditional Resources to Get Started with IBKR APIs

IBKR Campus offers several resources to help you integrate your strategies with our platform.

Traders’ Academy Courses on API

Traders’ Academy offers courses to help you:

- Trade, monitor and manage your IBKR account using the Client Portal API.

- Use Excel together with TWS API to manage your account and automate your trading strategies.

- Code Python applications using the Python TWS API.

- Use R to automate trading, perform back-testing and analyze trading strategies.

IBKR-API Home

Interactive Brokers’ complete API documentation encompassing the Web API, Trader Workstation (TWS) API, Excel API, and FIX protocol. Find documentation and reference API materials for IBKR’s powerful trading platform.

Visit API HomeIBKR Quant Blog

The IBKR Quant Blog serves quantitative professionals who have an interest in programming. Discussion topics include deep learning, IBKR API, artificial intelligence (AI), Python, R, C#, Java and more.

Visit Quant BlogFAQ About APIs

Feature Comparison

| Feature | Web API | FIX API | TWS API |

|---|---|---|---|

Digitally Create and Manage Client Accounts |

|||

User Authentication Gateway |

|||

User Authentication Bearer/SSO/Oauth |

|||

RESTful API + Websockets |

|||

Broad Selection of Order Types |

|||

Access to IBKRs entire suite of Order Types |

|||

Account and Profit & Loss information |

|||

Market Data - Snapshots, Streaming, Historical |

|||

News |

|||

Block Allocation Trading for Advisors |

|||

Aggregate User Support |

|||

Real-Time Drop Copy |

= Included

API Use Cases, Services, and Getting Started

Retail, Day or Algorithmic Traders

Used by

Retail, Algorithmic and Proprietary Traders

Available Services

- Trading

- Trading at Scale

Web API

- Trading

FIX API

- Trading at Scale

TWS API

- Trading

- Reporting

Institutional

Used by

Proprietary Traders, Hedge Funds, Fund Administrators and Global Banks

Available Services

- Trading

- Reporting

- Trading at Scale

Web API

- Trading

- Reporting

FIX API

- Trading at Scale

TWS API

- Trading

- Reporting

Enterprise

Used by

Introducing Brokers, Independent Broker Dealers, Registered Investment Advisors, Global and Regional Banks

Available Services

- Trading

- Reporting

- New Account Registration & Maintenance

- Funding

- Trading at Scale

Web API

- Trading

- Reporting

- New Account Registration & Maintenance

- Funding

FIX API

- Trading at Scale

TWS API

- Trading

- Reporting

Third Party Developer

Used by

Payments, Turnkey Asset Management Platform, Trading, Analytics, Performance, and Planning Software Provider

Available Services

- Trading

- Reporting

- Trading at Scale

Web API

- Trading

FIX API

- Trading at Scale

TWS API

- Trading

- Reporting

Award Winning Platform & Services

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

#1 Best Online Broker

5 out of 5 stars

Best for

Advanced Traders

Best Online Broker