Client Portal

Client Portal

An intuitive platform for managing your account. Our single login platform is designed with your needs in mind. Setup a quick trade on-the-go, view your portfolio at-a-glance or manage your account settings.

The Interactive Brokers Advantage

- Client Portal serves as a one-stop resource for trading, checking quotes, reviewing global market data and news, monitoring account balances and managing account information.

- Trade with Client Portal's simplified trading interface. Just click the trade button to open a trade ticket, preview and place orders.

- Access PortfolioAnalyst, our free tool for consolidating and analyzing your complete financial portfolio.

- Use Fundamentals Explorer to access market-moving news and research and an expanded events calendar to stay on top of market activity.

- Access more than 100 technical indicators and 70 drawing tools to create comprehensive charts.

- Use Client Portal to communicate with Client Services, browse FAQs, or access the Investors' Marketplace of third-party service providers.

A Full Service Portal

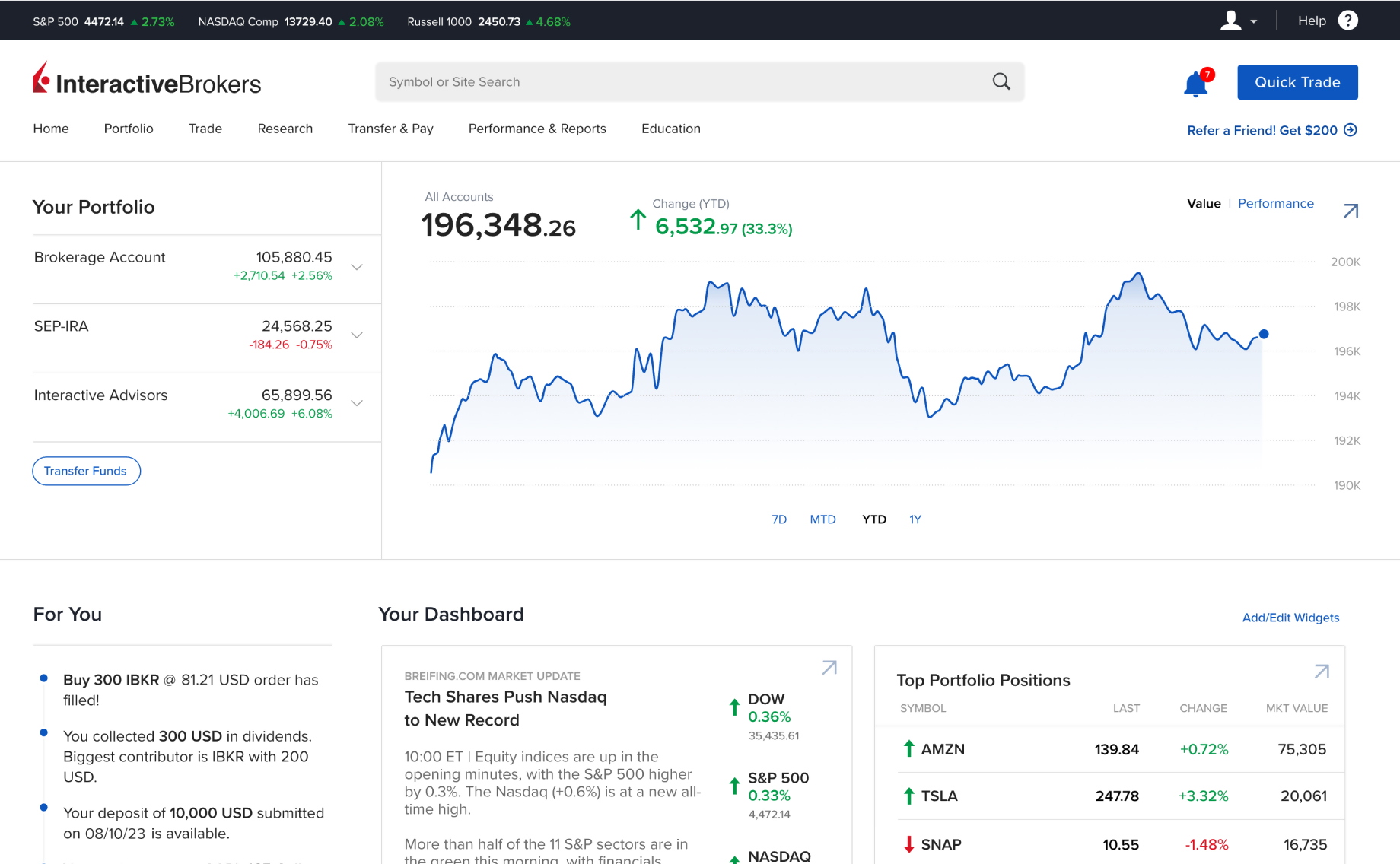

Client Portal makes it fast and easy to trade, fund your account, view your transaction history, transfer funds, adjust positions, manage direct deposit and much more.

The dashboard presents you with a snapshot summary of your account balances and portfolio performance, plus real-time market activity and breaking news.

From there, you can:

- Consolidate, track and analyze your complete portfolio, including non-IBKR accounts such as brokerage, checking, savings, annuity, incentive plan and credit cards.

- Optimize taxes and access supplemental tax information and reporting.

- Generate account statements — activity, performance and custom – and a wide range of other reports, including Risk, TCA and more.

And for immediate answers to common questions use the IBot FAQ, or chat with our Client Services team.

Trade Worldwide

Client Portal

Client Portal helps you discover and act on trading opportunities across global markets.

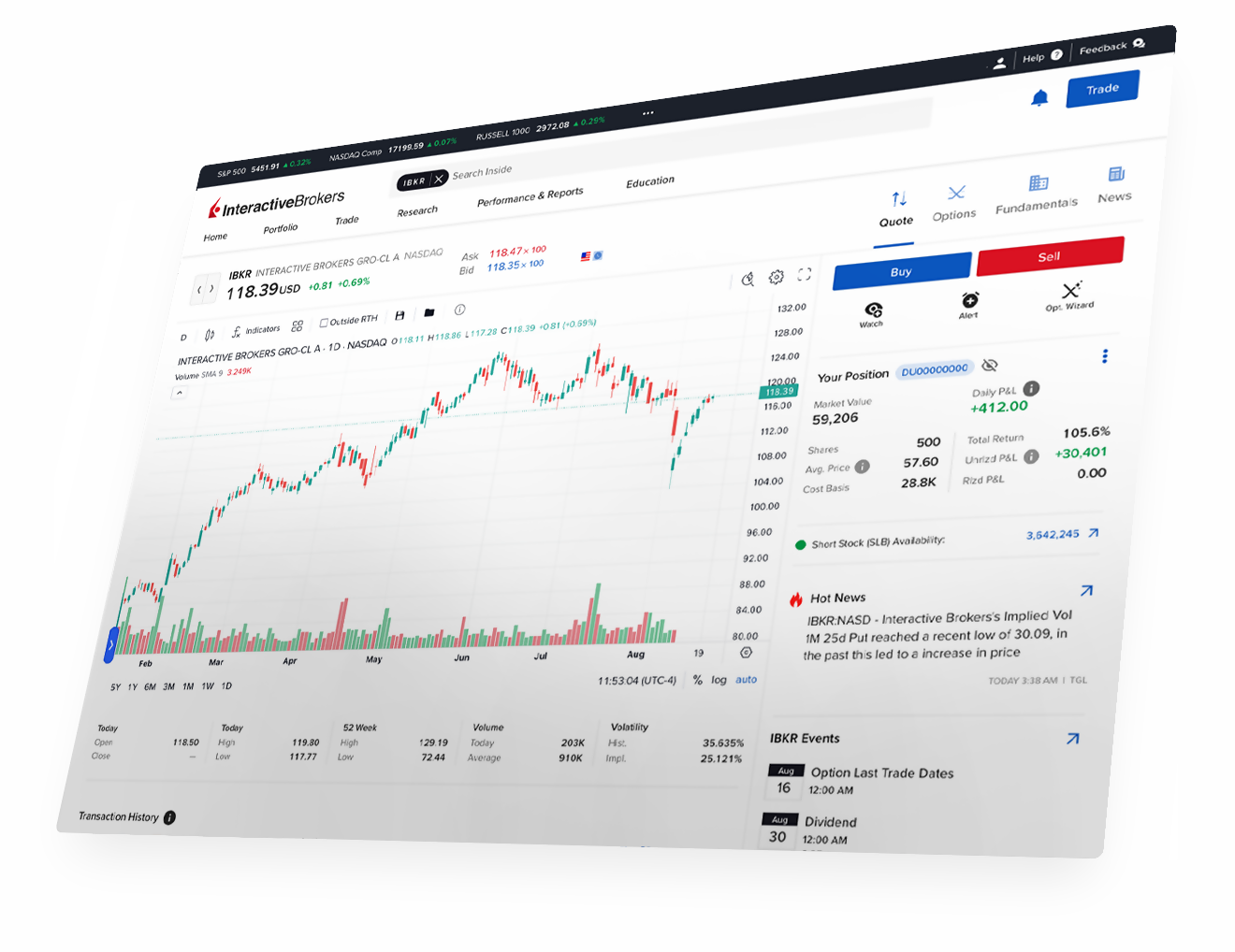

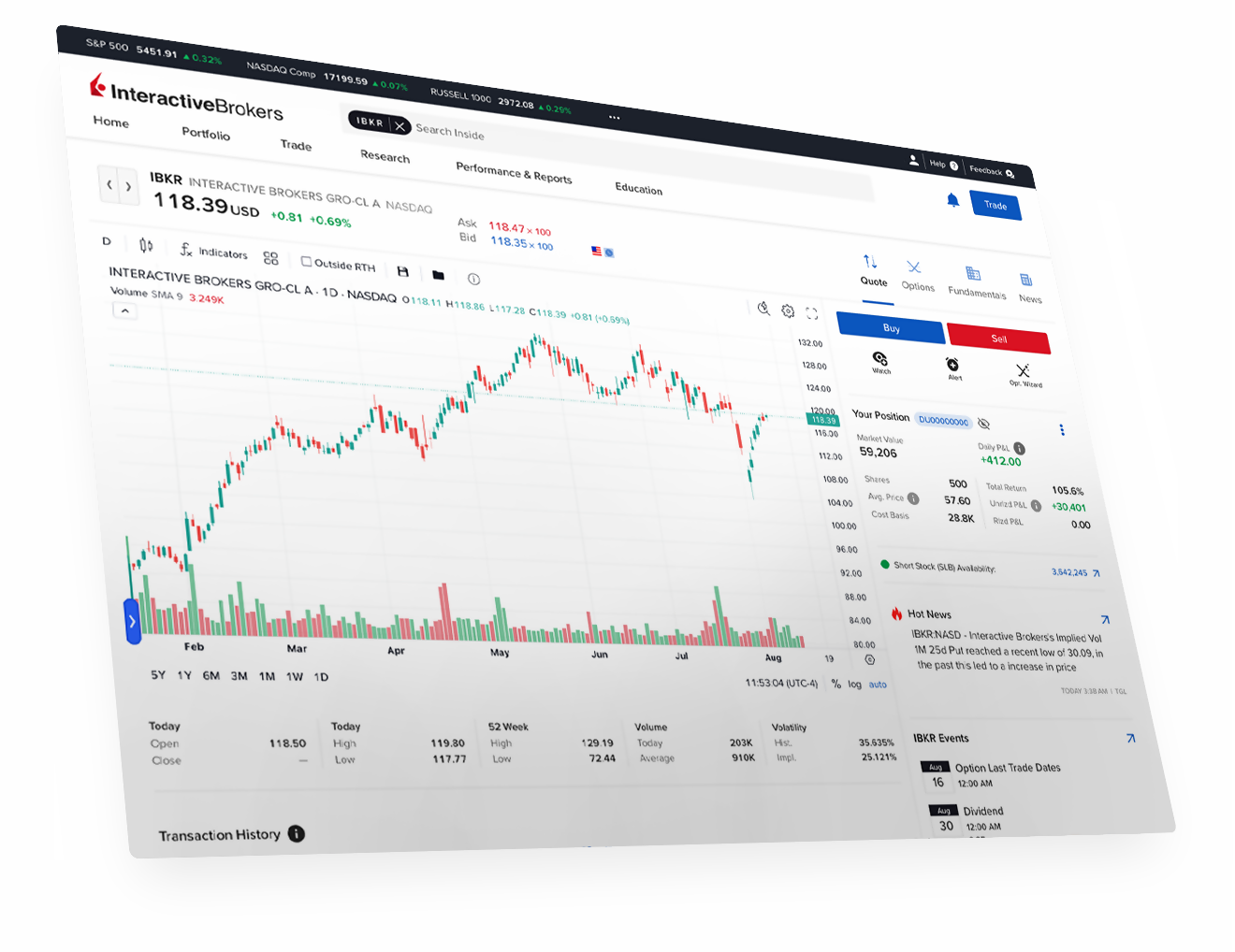

Click the Trade button to open a trade ticket, preview and place orders. You can also search for symbols, select a security type, and configure and transmit orders.

- Expand any position to see comprehensive product information on the quote details page.

- Create Watchlists and use the Market Scanner to scan more than 160 markets in 36 countries. Fund your account and trade assets in 28 currencies.*

- Trade stocks, options, futures, currencies, bonds, funds and more from a single unified platform .

Analyze Your Portfolio

PortfolioAnalyst

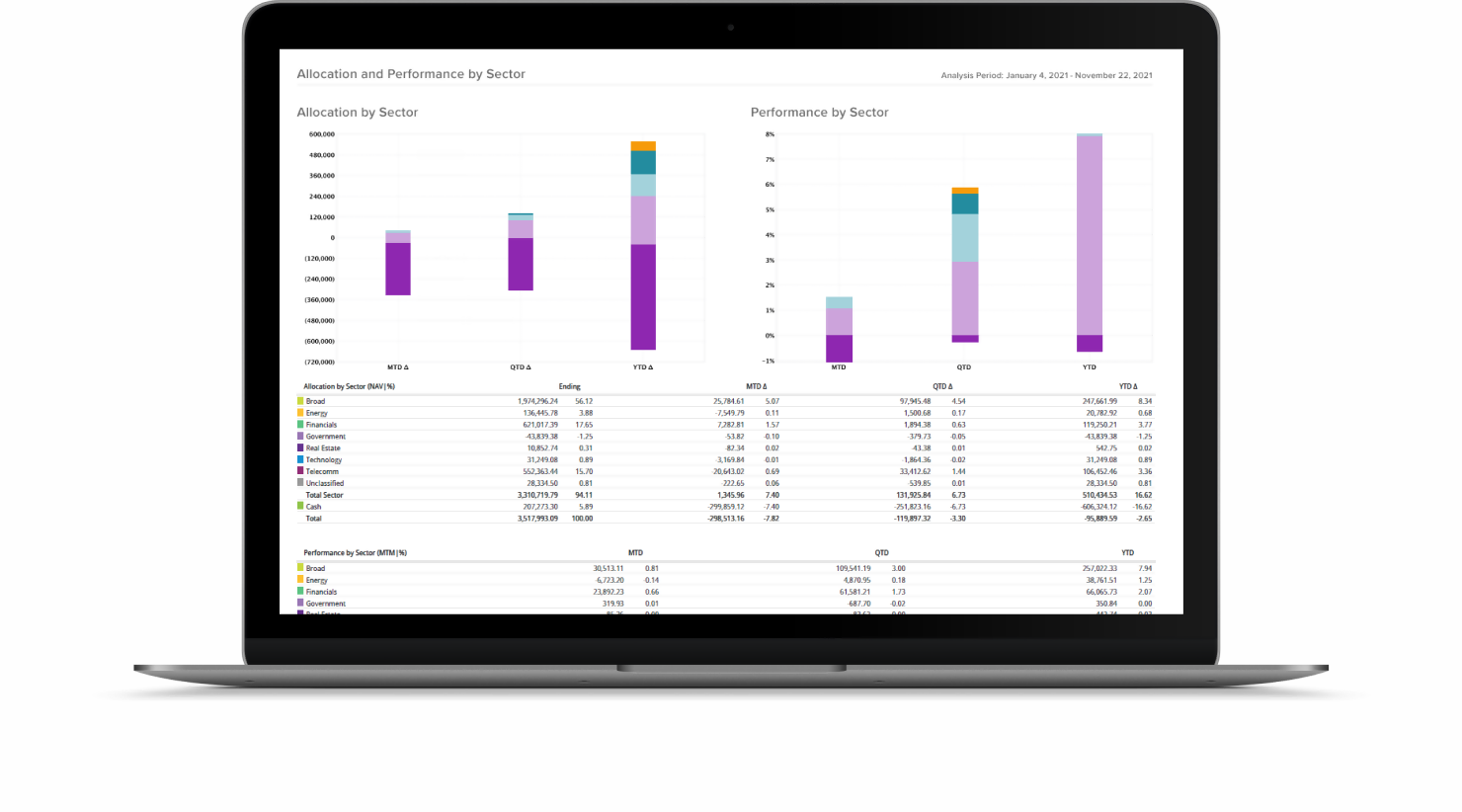

Client Portal includes PortfolioAnalyst, our free tool for consolidating, tracking and analyzing your finances. Combine your Interactive Brokers account with your other brokerage, banking, incentive plan and credit card accounts for a whole-portfolio view of your finances.

Reporting

Quickly generate account activity or performance statements. Use Flex Queries to create insightful analyses of your account and quickly generate reports to measure risk, perform transaction cost analysis or evaluate returns. Supplemental tax information is available for your record keeping.

Services

Providers

Services

Development

Client Support

Investors' Marketplace

Client Portal provides access to the Investors' Marketplace, where you can find a service provider or advertise your services to clients from over 200 countries and territories.

*Available currencies vary by Interactive Brokers affiliate.