Spread Orders

A spread order is a combination of individual orders (legs) that work together to create a single trading strategy. Spread types include futures spreads, and combinations of option/option, option/stock and stock/stock on the same or multiple underlyings.

When your spread order is transmitted, IB SmartRouting will compare native spread prices when available (i.e. ISE) with implied spread prices from all available option and stock exchanges and route each leg independently to the best priced location(s). If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue(s). Non-marketable spread orders native to the ISE on a single underlying will be temporarily routed to the ISE book, while non-marketable orders that are not native to the ISE will remain at IB. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution.

When using the ComboTrader Generic tab, only two-legged spreads will be considered valid unless the spread is natively traded on at least one exchange. To ensure that your multi-leg spread is valid, use the Strategy templates on the Single or Multiple tabs.

You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including via the ComboTrader, the SpreadTrader and the OptionTrader.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Futures | US Products | Smart | Attribute | ||||

| Options | Non-US Products | Directed | Order Type | ||||

| Stocks | Time in Force | ||||||

| Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

Example

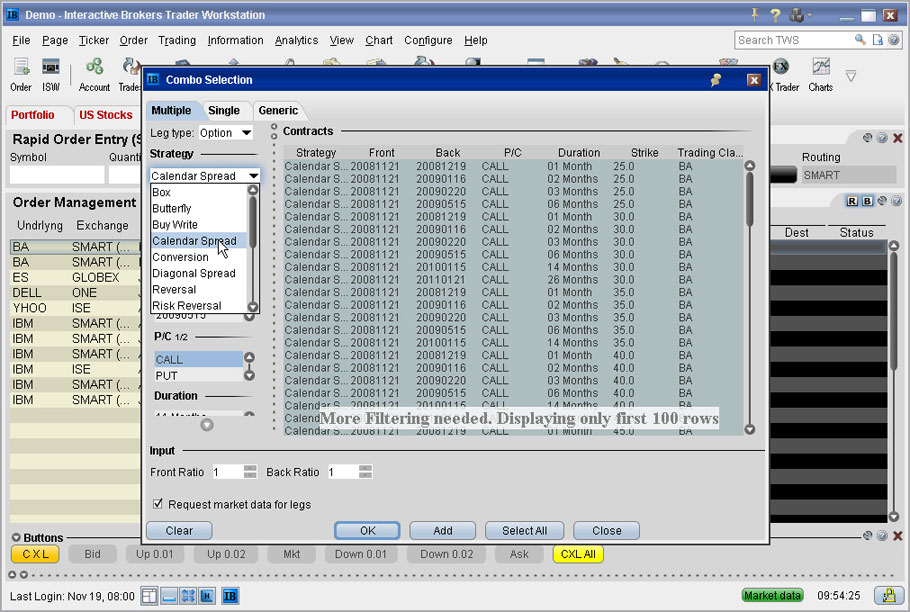

ComboTrader

This example shows you how to set up a calendar spread using the ComboTrader. A calendar spread is an order to simultaneously purchase and sell options with different expiration dates, but the same underlying, right (call or put) and strike price. The option you want to buy is a January 2009 call with a strike of 70 and a multiplier of 100. The option you want to sell is a December 2008 call with a strike of 70 and a multiplier of 100. First, click Combo in the TWS toolbar to display the Combo Selection box, then select a strategy and use the Filter fields to add the two options to the spread order. Make sure the Action is set to Buy for the Jan09 option and Sell for the Dec08 option, then click OK. The spread appears as a market data line on your trading screen. Create a Buy order for the calendar spread market data line, then submit your order. To buy this particular calendar spread means:

1:Sell 1 XYZ OPT DEC 17 '08 70.0 CALL (100)

2:Buy 1 XYZ OPT JAN 16 '09 70.0 CALL (100)

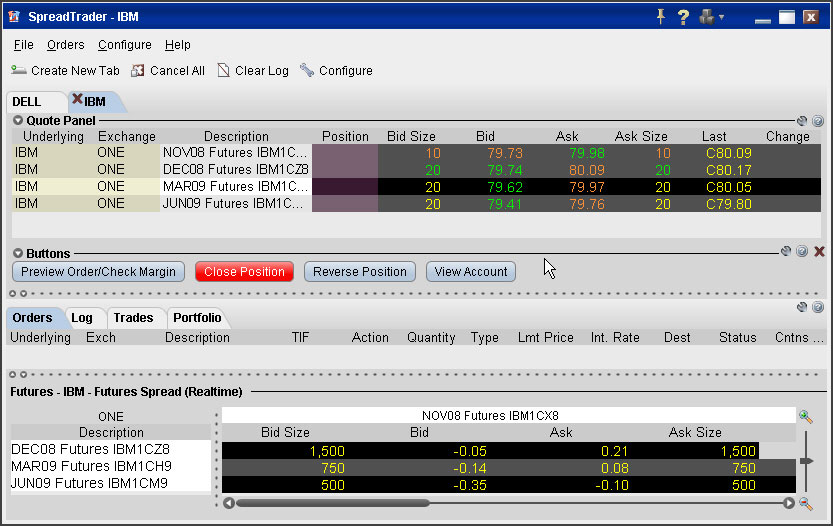

SpreadTrader

You can also use the SpreadTrader to create futures spreads, EFP futures spreads and option spreads. Just click SpreadTrader on the TWS toolbar to display the SpreadTrader.

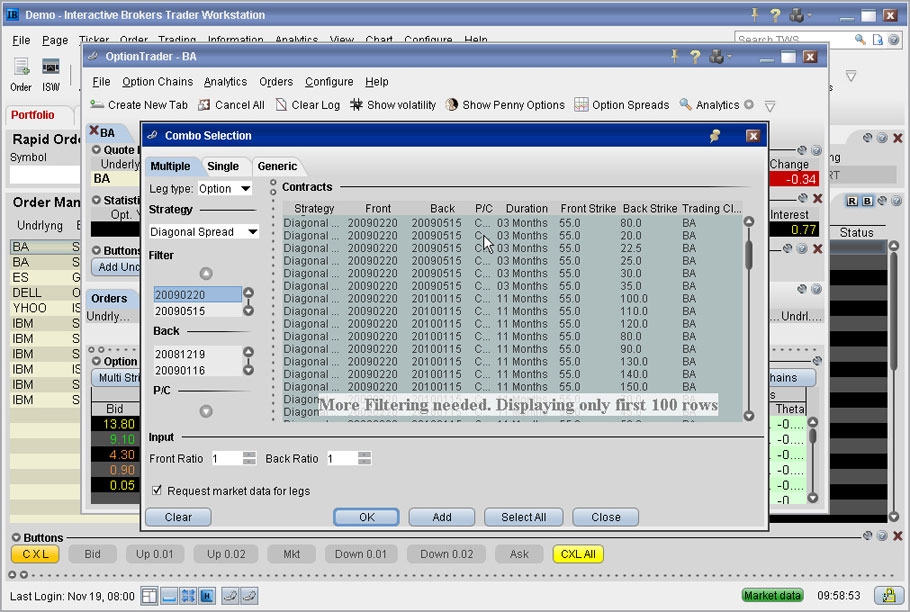

OptionTrader

You can also create option spread orders using the OptionTrader. Simply click OptionTrader on the TWS toolbar, then click Option Spreads in the OptionTrader to display the Combo Selection box, where you set up your spread order.